David Eccles School of Business

5 Coming of Age: Young Investors and the Rise in Riskier Investments

Kacey Tollefson

Faculty Mentor: Nathan Seegert (Department of Finance, University of Utah)

Abstract

By the year 2034, Generation Z (currently those between 12 and 25 years of age) is projected to become the largest generation with an estimated 78 million individuals (Morgan Stanley, 2014). In all respects, this rising generation is taking the world by storm- especially in the investment sphere. Not only are there more young investors than any generation that proceeded them but they’re also more likely to take risks- knowingly or unknowingly. A basic framework for making an investment decision includes defining one’s investment objectives, researching opportunities, and allocating funding across selected assets. While Gen Z is just as motivated to save for retirement as the older age groups, they’re also the most interested in getting rich. Influenced by their heavy utilization of social media, young people are making investment decisions contrary to sound financial principles; this includes taking on debt to invest and by buying assets with arguably no intrinsic value. On the contrary, this generation is expected to be the most educated with the highest probability of having college educated parents. They are also consuming less alcohol and have less teenage pregnancies than previous generations (Hawkins et al., 2022). Millennials and Gen Z are investing in retirement at a younger age than their parents and grandparents and strive for financial independence. Consequentially, many young investors are doing their own investment research as opposed to using index-based mutual funds or by working through financial advisors. While many would argue that financial markets are efficient, these ‘young guns’ don’t believe that’s the case and are willing to make trades against it. Their extensive involvement in high frequency trading has led several behavioral finance professionals to correlate it with gambling, especially as young investors seek high short term yields as opposed to consistent investing. This paper will analyze how the evolution of equity market trading has allowed for increased access to markets in modern times. It will also relate generational differences between investors to compare risk tolerance and investment preferences.

Keywords: Generation Z, risk tolerances, behavioral finance, high frequency trading, investment strategies and investment objectives

Introduction

Strategic investing has long been regarded as a wise tool for both wealth creation and building generational wealth. Participation not only allows one to prepare for future expenses but also as a hedge against risks such as inflation. Prior to the 1980’s, market participants were comprised of institutional investors and individuals with extensive educational backgrounds. The process of exchanging assets was complex and often limited participants to certain geographical areas. The invention and adoption of digital technology simplified this process and allowed more investors to participate.

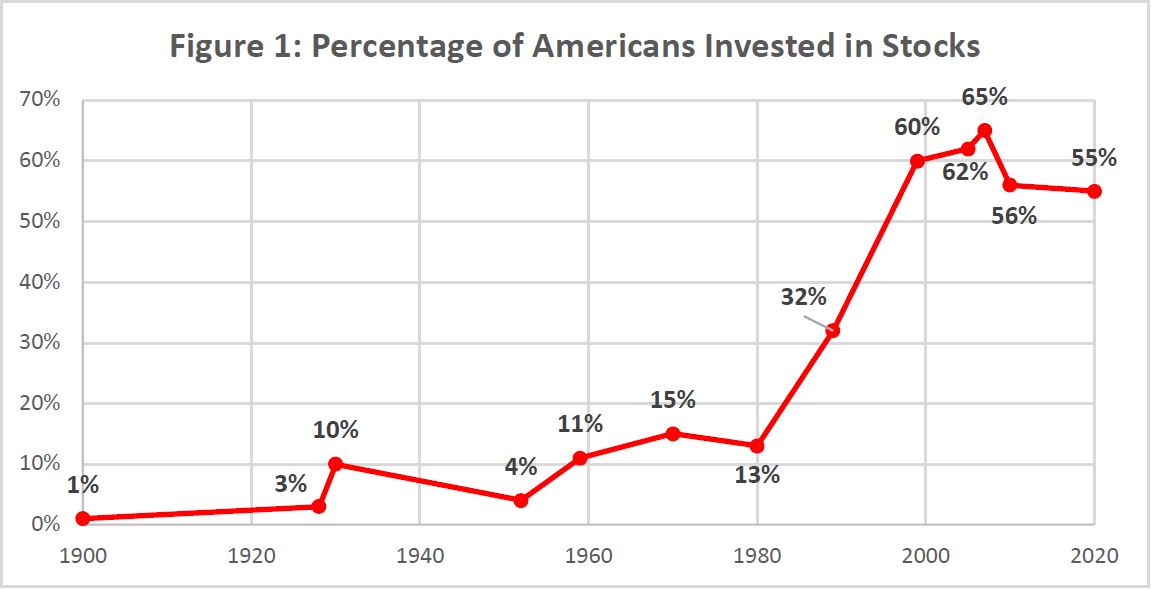

The transition from a small number of investors to the majority of Americans didn’t happen overnight. As of 1900, only about 1% of Americans had equity investments, but by 2021 this proportion increased to 55%, (as shown in Figure 1). This shift was fueled by economic prosperity, financial innovations, and better data transparency.

Figure 1: Percentage of Americans Invested in Stocks

Data source: https://www.pbs.org/fmc/book/14business6.ht

Beginning in the late 1800s, railroad companies were some of the first few American institutions to issue stocks and bonds (Beattie, 2023). These assets were fairly illiquid and were only held by wealthier clients seeking long-term growth, or about one percent of the entire United States population. This proportion would later grow to a high of 10% in the late 1920s due to economic success and larger disposable incomes.

According to the U.S. Census Bureau (2021), America’s economy grew 42% in the 1920s. Innovations such as the radio spread information much faster than the traditional newspaper, updating the public with economic or financial news in real time. More than 25% of families had their own car and airplane travel was up 287% (Armadeo, 2022). In 1928, stock prices rose 39% following a five-year bull run that began in 1923. Unfortunately, this long-term market success was severely corrected on October 29, 1929, (otherwise known as “Black Tuesday”), when billions of dollars of wealth were wiped out in a single day, effectively ushering in the Great Depression. This economic decline coupled with a lot of distrust and speculation about the market reduced the proportion of Americans with stock back down to 4.2% by 1952.

It was not until 1954 that the Dow Jones Industrial Average recovered to its pre-depression levels. With the introduction of Standard and Poor’s 500 index (S&P 500) in 1957, mutual funds grew in popularity over the next several years as it allowed a better way for previously hard-hit investors to diversify their holdings (Anderson, 2021). On February 8, 1971, the NASDAQ exchange was launched as one of the world’s first electronic stock markets. These improvements increased investor access to financial markets, raising American participation rates to an all-time high of 15% in 1970 before eventually settling back down to 13% in 1980.

The following two decades saw strong economic growth with the S&P 500 increasing 17.4% annually as opposed to its historical 9.7% annual return (Vise, 1989). Despite the political tensions of America’s involvement in foreign affairs, trust in the markets remained high, especially as inflation rates dropped from 15% in 1980 to 3% by 2000 (U.S. Bureau of Labor Statistics, 2021). According to the Economic Policy Institute, it wasn’t until the third quarter of 2001 that the economy experienced its first contraction since 1993 (Weller, 2002). These movements and conditions subsequently increased equity market participation from 32% in 1990 to a high of 60% in 2000.

As of 2020, it is estimated that 55% of Americans are invested in stocks. Over time, periods of strong economic growth and technological advancements have proven to increase participation in the market, and the same holds true for our currently young, rising generation. Several new brokerage firms such as Robinhood and Public offer equity and crypto market trading with no transaction fees. The obsession over social media as a news source has increased financial awareness not only for stocks but for alternative investments such as cryptocurrency and derivatives trading.

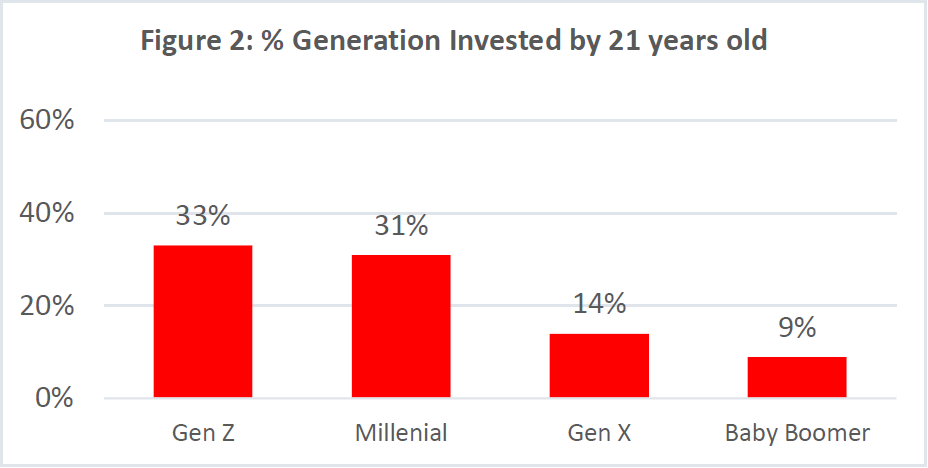

According to Fortune magazine, “Today’s millennials and Gen Z have more economic power than any generation that preceded them. They are earning more, saving more, and investing earlier and at a higher rate than previous generations” (Case, 2021). These younger generations are eager to prepare for the future by starting earlier. A recent study by the CFA Institute (2022) found that 33% of Gen Z and 31% of millennials made their first investments before 21 years of age, presenting a statistically higher level of participation than preceding generations, with Generation X at 14% and Baby Boomers at 9%, (see Figure 2). For purposes of this study, those belonging to Gen Z are considered those born between 1997 and 2012, millennials are born between 1981 and 1996, Generation X are born between 1965 and 1980, and Baby Boomers are born between 1946 and 1964.

Figure 2: % Generation Invested by 21 years old

Data source: Fortune magazine, based on a NASDAQ study

While saving and investing early on has its advantages, making those decisions prematurely without a sound understanding of financial markets or their associated risks is worrisome. Both Baby Boomers and Gen X were raised by parents who endured the Great Depression, and according to Spectrem Insights’ study (2014), this generation that “came of age during the economic collapse and subsequent recession,” has developed a more cautious risk tolerance. Conversely, most of Gen Z has not experienced financial challenges or investment risks and as such may have a higher risk tolerance.

As per FINRA’s 2018 report, parents are engaging in more investment-related discussions with their children than before. While this does not imply a causal link as to why younger people are investing more, it does highlight growing financial awareness among the younger generations. This study will examine whether the young generation’s increased level of participation and investment decisions are demonstrating a higher risk tolerance than those who preceded them.

Methods

The younger generations are being brought up in a world of technology. The youngest member of Gen Z was only 10 years old when the first iPhone came out. Information is now available at the touch of a button, and commission free trading platforms make it much cheaper for individuals to invest. Social media has become a powerful tool for information and sharing ideas, especially in the investment space. All of these factors are influencing a generation to act and invest sooner than any that have proceeded them.

This research focuses extensively on behavioral finance and risk tolerances between Gen Z/millennials and those belonging to the Gen X/Baby Boomer generations. This will be accomplished by using an investment decision making framework of (1) defining investment objectives, (2) data and information collection, and (3) asset allocation.

Investment objectives can be defined as the goals or strategies an investor has for entering into an investment. These goals might include preparing for retirement or saving up to buy a house. Data and information collection is the process of performing technical research and valuations of different investment opportunities that will help an investor achieve their investment objectives. Asset allocation involves buying, selling, and balancing one’s portfolio of assets to maximize returns while reducing risks. A consistent strategy entails aligning all three phases of this process.

For example, an investor preparing for retirement may elect for more volatile assets such as stocks in the beginning. As the investor gets closer to retirement, it is generally advisable to move towards safer, less volatile assets such as bonds to create a more stable portfolio value (Beagle, 2023). In this study, we will relate each of these phases between the younger and older generations to observe differences in investment objectives and motivations.

This study is being conducted under the hypothesis that young investors aren’t as financially literate as their predecessors and are therefore making riskier investment decisions. Several areas we will investigate for this generational comparison include their trusted or most used sources for financial advice, the length of time spent studying investments, how often they monitor their portfolios/what’s in them, how frequent they trade, and differences in money sources being used to invest.

Results

Investment Objectives

An investor seeking to generate additional wealth through investing will typically do so with an end goal in mind. This can include buying a house, saving for a child’s college fund, retiring or even just to build generational wealth. These incentives often influence the type of assets one should buy and how long to hold them for. For this reason, an investor’s time horizon and risk tolerance are taken into consideration when building an investment objective. The longer an investor has before their targeted return date, the more likely they’re able to benefit or recover from riskier portfolios.

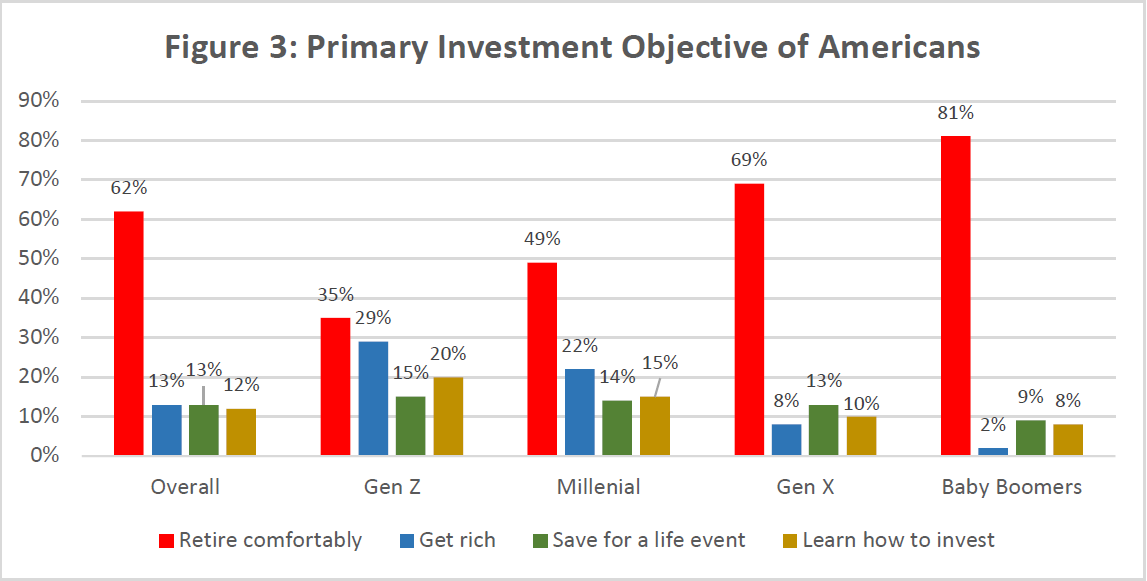

As it turns out, every age cohort’s main objective for investing is to eventually retire. A recent 2022 study conducted by MagnifyMoney found that of the 670 investor respondents, 62% of them wanted to retire comfortably. Figure 3 illustrates that although this goal is at a majority across all generations, its prioritization grows the older an investor gets (Cook, 2022). Interestingly enough, the next highest motivation for investing among Gen Z and millennials was to get rich, at 29% and 22%, respectively.

Figure 3: Primary Investment Objective of Americans

Data source: https://www.magnifymoney.com/news/investing-by-generation-survey/ total may not add to 100% due to rounding

Understandably young investors may not be as concerned about retirement given that its farther away from them, but the study also highlighted how Gen Z and millennials are also interested in learning how to better invest. Given that such a higher proportion of these young individuals are investing than before, it’s likely that they don’t have financial experts or colleagues to consult with and are therefore learning to invest on their own. Their motivations, though, are more mixed.

Another study conducted by The Royal Mint, the United Kingdom’s currency manufacturer, supported the findings of the adolescent “get rich quick” mentality. Their study found that 17% of respondents started investing after seeing substantial investment successes on social media, which unfortunately turned out to financially worsen many of them (The Royal Mint, 2022). Nearly two thirds of their respondents aged 16-25 years old reported severe losses, so much so that many of them are now focusing on diversification than picking the next big stock.

These findings suggest that although retirement is of importance to Gen Z, they’re also willing to take a lot of chances and learn through experience. Their relatively young age affords them more time to recover from potential risks, especially as they learn wise investment principles such as the value of asset diversification.

Data & Information Collection

Gone are the days of reading the newspaper or having to ask your neighbor what they heard on the radio. TikTok, Instagram, Facebook and Snapchat are all the new norms of staying involved and up to date. These free platforms allow users to build a network of trusted family and friends while also exposing them to popular channels or influencers. These influencers have a significant online following and usually gain the trust of those who follow them. Their social status affords them influence on their followers such that they are highly persuasive on things such as purchasing products or making investment decisions.

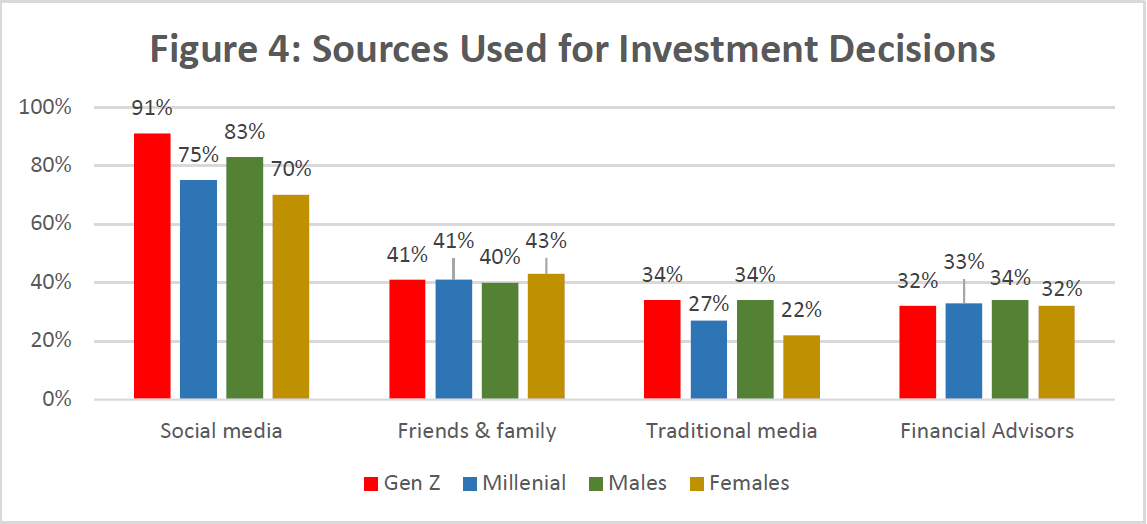

According to a 2021 Motley Fool survey with 1,400 respondents between the ages of 18 and 40, social media ranked as the highest information source for making investment decisions. When asked, “Please select the types of resources used to get information on investing in the past 30 days,” 91% of Gen Z and 75% of millennials selected social media as opposed to 41% for friends and family (Caporal, 2021). Figure 4 illustrates that when it comes to risking one’s own money, young investors are more likely to rely on social media stars they’ve never met in-person than their own familial relationships.

Figure 4: Sources Used for Investment Decisions Gen Z Millenial Males Females

Data source: https://www.fool.com/research/gen-z-millennial-investors-tools/

The inherent danger of relying on social media as an information source is that those giving financial advice aren’t accredited to do so. Financial planners are individuals who help manage your investment portfolio, and although not required to gain accreditation and certification, many of them do so to both improve their credibility and expertise. A Certified Financial Planner must undergo extensive educational and ethical training in addition to thousands of hours of financial planning experience before they can get certified.

For financial social media influencers, or “Finfluencers”, their credibility can be easily manipulated through the number of video likes or followers they have. Popular advertisements such as, ‘How I made $X in 30 minutes’ are eye-catching for inexperienced investors who might not be financially well off. This leads these individuals to invest on the illusion of getting high future returns even though it’s based off of an influencer’s performance in the past.

Take Kim Kardashian, for example. In June of 2021, without disclosing her $250,000 incentive from EthereumMax, Kim promoted their cryptocurrency to her then 220 million followers on Instagram (Sweney, 2022). Sixteen months later the coin had lost 95% of its value and Kim was hit with a $1.26 million fine from the SEC for failing to disclose she was being paid to post her recommendation (Hartmans, 2022). While no one can definitely say whether an investment will be successful or not, popular influencers or celebrities commandeer a lot of trust from the public in what they recommend doing.

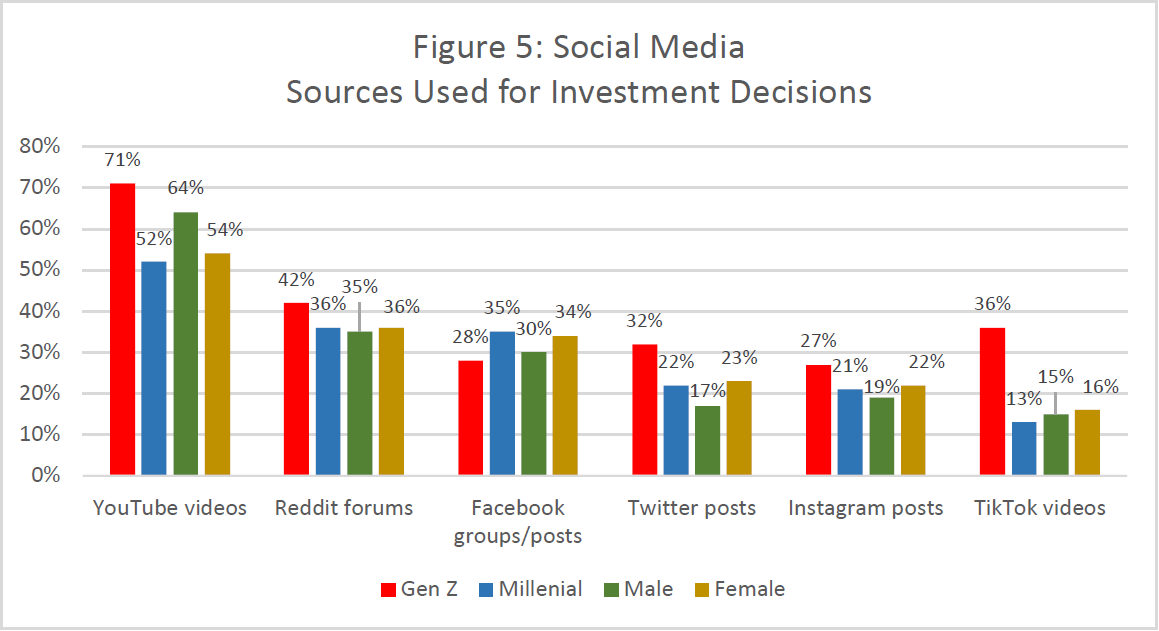

In terms of the most popular social media sources used for making investment decisions, the same Motley Fool survey found that 71% of Gen Z respondents used YouTube, 42% used Reddit, and 36% used TikTok (Caporal, 2021). Millennials yielded similar results with 52% using YouTube, 36% using Reddit, and 35% using Facebook (see Figure 5).

Figure 5: Social Media Sources Used for Investment Decisions Gen Z Millenial Male Female

Data source: https://www.fool.com/research/gen-z-millennial-investors-tools

Due to several laws limiting financial advice giving to accredited professionals, many YouTube channels or livestreams have the disclaimer “this is not trading advice” when talking about investment strategies. Unfortunately, however, falling into the trap of trusting these channels due to illusory credibility is far too common. Take Chris Boutte, a young author and social media influencer himself, for example.

In 2021, Chris decided to become a “financially responsible adult by investing and saving for [his] future” (Boutte, 2021). After receiving a few thousands of dollars as an inheritance, Chris turned to something he was familiar with- YouTube- to learn what to do with it. “Many of the YouTubers I watched are millionaires, so I assumed they knew what they were talking about. I was drawn by the belief that these people were experts.” Unfortunately for Chris, this trust cost him about $3,300.

After listening to several YouTubers advocate that Coinbase’s upcoming IPO shares should be valued at $700, Chris convinced himself not to buy, even though shares started trading at only $381. After rising to $429, he started to regret his decision; but once they dropped back down to $333, he said, “I figured I’d be a fool if I didn’t buy. I bought three shares, and I’ve been losing money ever since.”

While professional financial advisors can certainly get things wrong as well, Chris’ mistake was getting caught up in the “fanaticism” of YouTube on certain stocks. After he started incurring losses, Chris went back to see just how many of his favorite YouTube channels were right, but not many of them were. “I learned the expensive lesson that these YouTube “experts” should only be watched for entertainment purposes, and that’s about it,” Chris concluded.

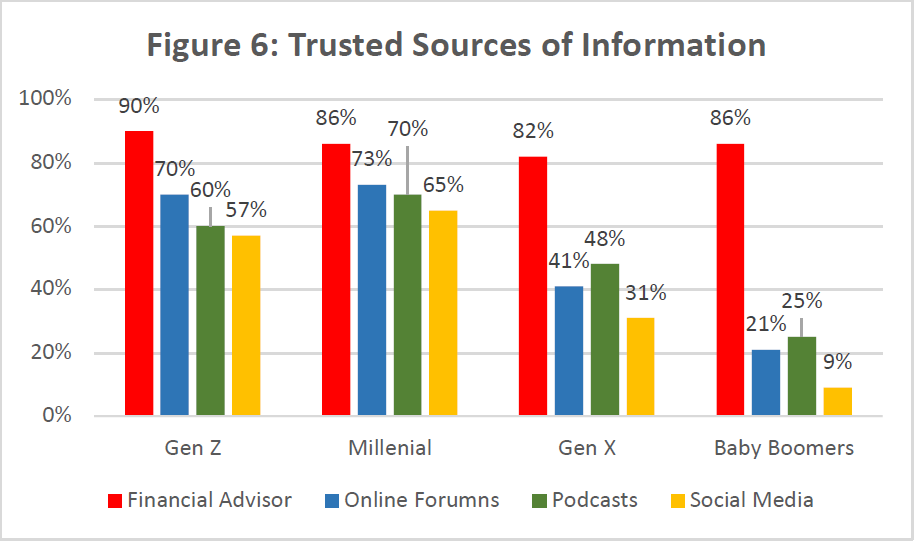

While Gen Z and millennials are going to more untraditional sources for investment advice, many of them still trust financial advisors the most. According to a recent NASDAQ survey, financial advisors were ranked the highest in terms of trustworthiness (NASDAQ, 2022). Although millennials and Gen Z rely heavily on social media, they trust online forums and podcasts more (see Figure 6).

Figure 6: Trusted Sources of Information

Data source: https://www.nasdaq.com/docs/etps-empowering-next-gen eration-of-investors

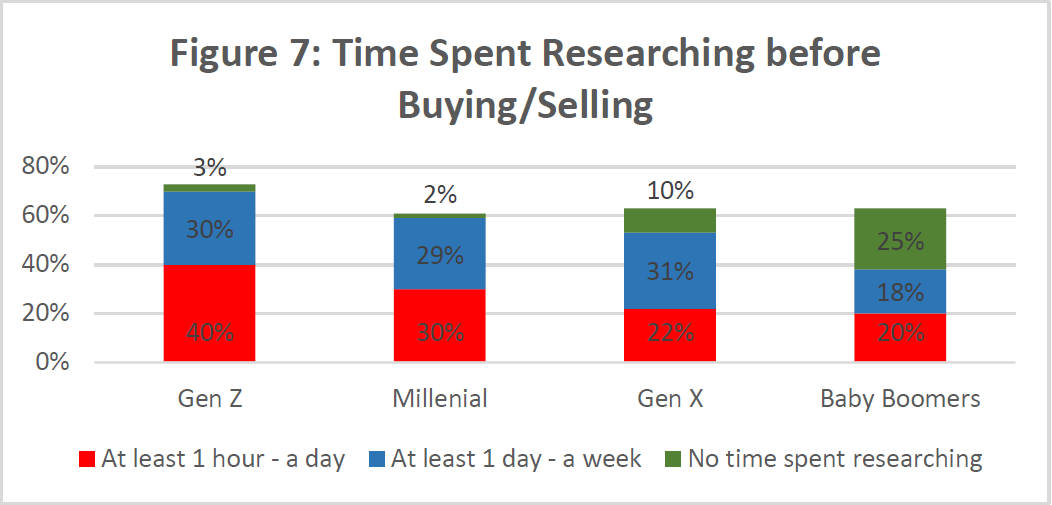

While these young investors may trust credible advisors the most, they’re also the least likely to use them. This doesn’t mean they aren’t doing their own research, however. Based on the same 2021 NASDAQ survey, Gen Z and millennials are actually spending the most time before buying/selling an asset (see Figure 7). According to the survey, 40% of Gen Z respondents spent at least one hour to one day researching with the proportion declining the older the generation gets (NASDAQ, 2021). In terms of researching one day to one week, Gen Z, millennials, and Gen X have similar proportions near 30%, with Baby Boomers at only 18%. A quarter of Baby Boomers don’t do research at all before investing, but this could be a result of their investment experience or financial advisors doing the research for them.

Figure 7: Time Spent Researching before Buying/Selling

Data source: https://www.nasdaq.com/docs/etps-empowering-next-gen eration-of-investors

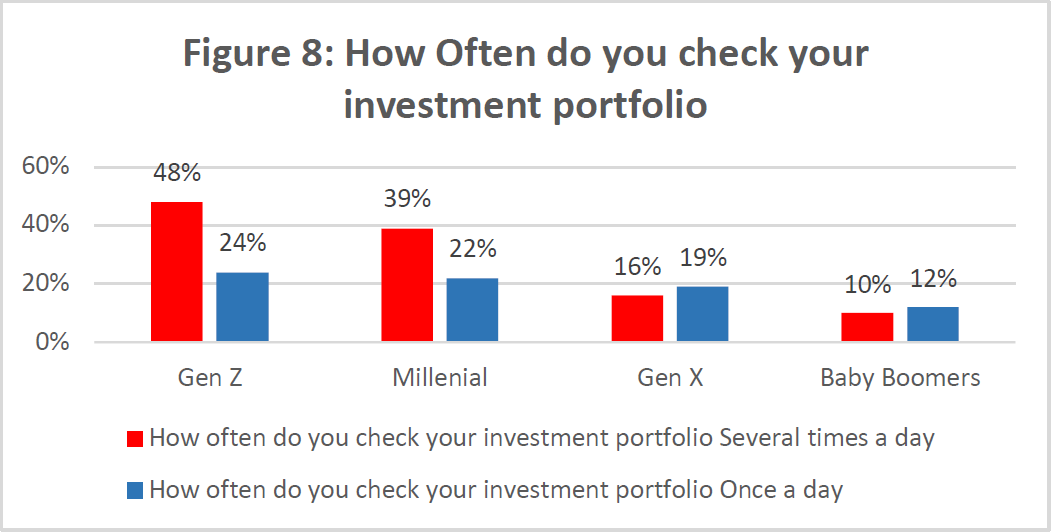

Not only are Gen Z and millennials highly reliant on their own research but they are also obsessed with the performance of their investments. Whether that be out of eagerness for short-term, high yields or a lack of confidence, 48% of Gen Z and 39% of millennials check their portfolios several times a day (see Figure 8) (NASDAQ, 2021). This proportion falls by over half with only 16% of Gen X and 10% of Baby Boomers. On average, 19% of all age categories check their portfolios at least once a day, but young investors in particular are interested in more frequent monitoring.

Figure 8: How Often do you check your investment portfolio

Data source: https://www.nasdaq.com/docs/etps-empowering-next-gene ration-of-investors

In conclusion, younger investors aren’t afraid to turn to untraditional sources of information for investment advice. While they hold financial advisors as the most credible source in line with other generations, social media remains the highest used source. While the NASDAQ survey did not specify whether the time spent researching assets entailed any sort of technical analysis, young investors are obsessed with seeing how well they’re doing- or how much they’ve lost.

Asset Allocation

Historical finance classified investment assets as one of three different domains. These included equities, fixed income, and money market instruments. Equity investments, or buying and selling stock, have become more complicated with the introduction of options and derivatives. Options, or derivatives, provide a way to hedge, (or bet), on a stock’s future performance, whether it be an appreciation or depreciation in value. While not specific to equities, the value derivatives are contingent upon the price of the underlying asset or stock, (i.e., your option is only as valuable as the stock price’s movement).

Investing in fixed income investments entails buying or selling bonds, or debt instruments issued by companies or the government. United States Treasury bonds are frequently referred to as “riskfree” investments due to a perceived low risk of government default. Corporations and municipalities are also able to issue debt, however, fixed income assets usually don’t yield as high of returns as equity investments due to lower risk of default. In the event of a bankruptcy, debt investors are held at a much higher priority than equity investors, and most fixed income instruments are backed by a specific asset.

Money market instruments are short-term assets such as treasury bills, commercial paper, municipal notes, and certificates of deposit (or CDs). These assets are usually purchased at physical locations such as banks or directly from the government entity’s website. Due to the low risk, short term nature of these investment assets, they are also referred to as “cash or cash equivalents.”

More recently, alternative investments such as real estate, cryptocurrency, commodities, and derivatives have grown in popularity. Cryptocurrency is a form of digital currency stored by a decentralized system. When Bitcoin, (one of the first cryptocurrencies available), launched in January of 2009 at a price of $0.0008 USD, many people didn’t take notice. It wasn’t until 2011- 2013 that the coin started getting noticed, especially as it rose to a price of $64,800 per coin on April 14, 2021.

While the rest of the world saw a high value in Bitcoin, several experienced investors did not. Warren Buffet, CEO and chairman of Berkshire Hathaway, (whos portfolio value is calculated at around $299 billion), stated that, “Whether [Bitcoin] goes up or down in the next year, or five or ten years, I don’t know. But the one thing I’m pretty sure of is that it doesn’t multiply, it doesn’t produce anything. It’s got a magic to it and people have attached magic to lots of things” (Macheel, 2022). Many financial experts have argued over the intrinsic value of cryptocurrency or the lack thereof, and while this debate doesn’t fit the merits of this paper, it’s worth noting that cryptocurrency has demonstrated itself as a highly volatile asset whose true worth lies in the eyes of the market.

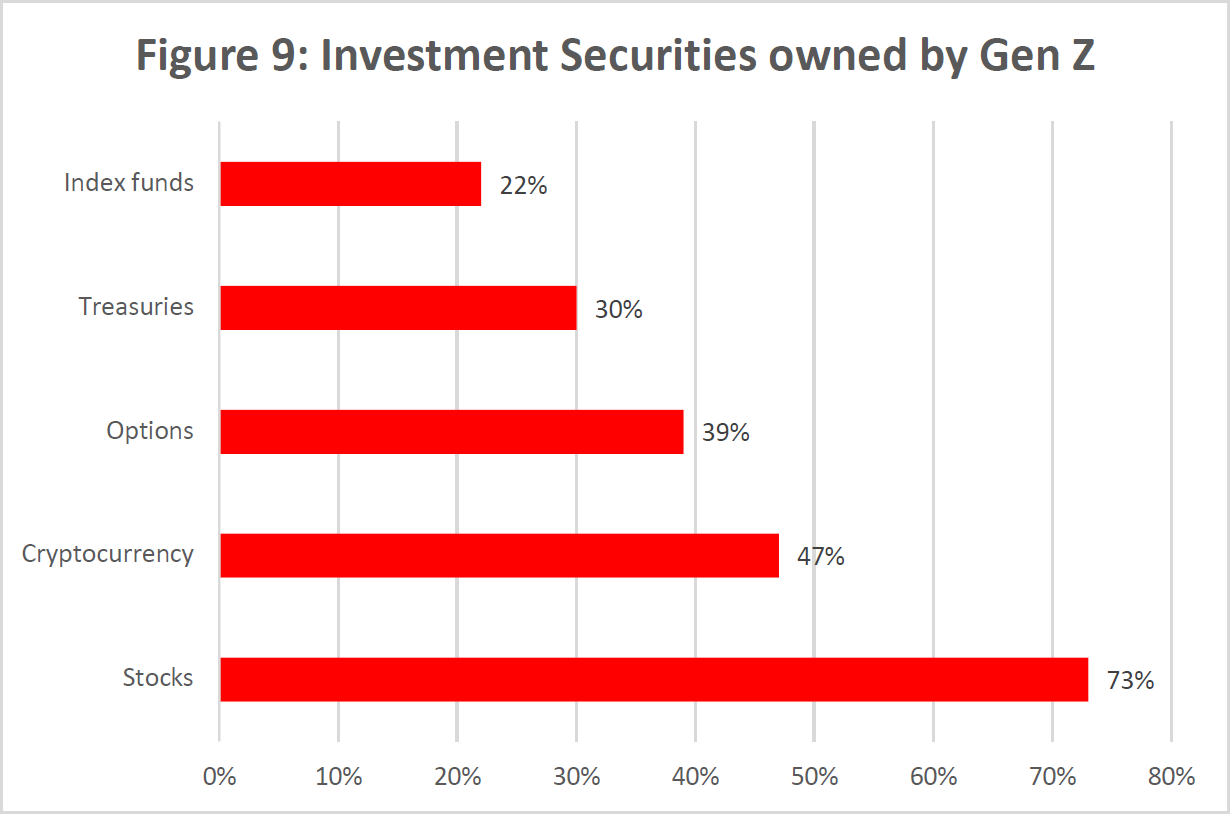

What does this mean for Gen Z investors? As it turns out, cryptocurrency is the second highest investment owned at 47%, proceeded only by stocks at 73% (Figure 9) (NASDAQ, 2021). The enormous uptick in Bitcoin price appreciation and its coverage on social media likely exposed these youth to investing for the very first time. This was the case for Chris Boutte who, like many of his peers, saw this potential for high reward as one you wouldn’t want to miss out on.

Figure 9 Investment Securities owned by Gen Z

Data source: https://www.nasdaq.com/articles/gen-z%3A-what-to-know-about-the-next -generation-of-investors

Despite Gen Z being a significant market participant in cryptocurrency, they also exhibit high levels of interest in options trading. Whether through puts, calls, forwards or futures, participating in options is often referred to as a zero-sum game- when one investor wins big, the other investor loses by the same amount. Selling call options in particular can be dangerous for an unsophisticated investor due to the uncapped potential of losses, but this generation has an alarmingly high level of participation in it.

Fortunately, however, 30% of Gen Z investors are invested in United State Treasuries, which in some way allows them to buy down some of the investment risks they’re participating in. In terms of equity investments, however, they’re also the least likely generation to use index funds.

According to both a MagnifyMoney survey and a Motley Fool study, Gen Z respondents were the least likely to be invested in index/mutual funds at 26% and 35%, respectively (Cook, 2022; Hawkins et al., 2022). Baby boomers were the most likely to be invested at 57%, followed by 38% of Gen X and 31% of millennials (Cook, 2022). A mutual fund is a collection of assets pooled together and sold in terms of shares, allowing investors to diversify idiosyncratic risk in a costefficient, hassle-free way.

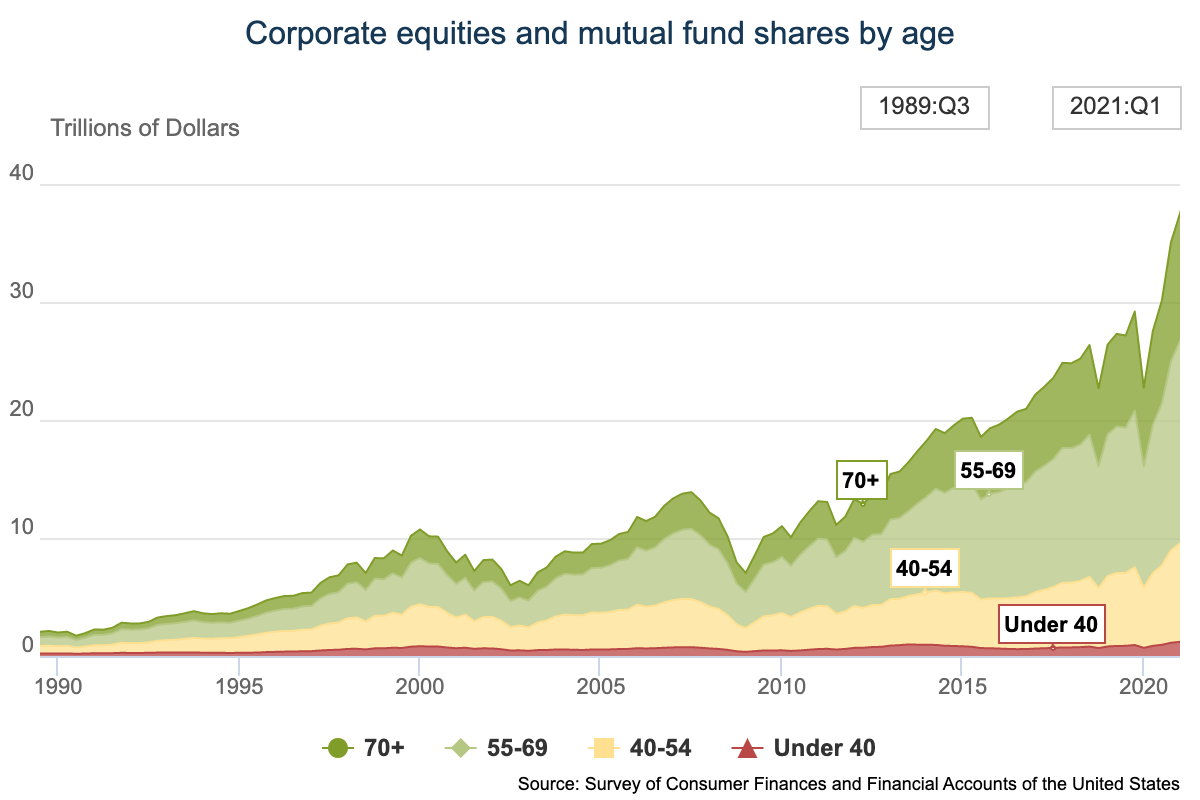

According to data published by the United States Federal Reserve in Figure 10, overall investments in mutual funds have risen at a compound annual growth rate of 16.16% since 2009. The Federal Reserve also provided data for those who were under 40, 40-54, 55-69, and 70+ years of age, wherein they found that those under 40 had the lowest CAGR of 12.18% (Federal Reserve, 2022). While many belonging to older generations are investing more money into mutual funds, the younger generations are not. Instead, younger investors are more interested in picking their own assets or stocks to buy.

Figure 10: Corporate equities and mutual fund shares by age

Data source: https://www.federalreserve.gov/releases/z1/dataviz/dfa/ distribute/chart/#quarter:126;series:Corporate%20equities%20and%20mutual% 20fund%20shares;demographic:age;population:1,3,5,7;units:levels;range:2010.1,2 021.1

By not relying on mutual funds or ETFs, investors have to take a more active approach in selecting which assets to buy and when to sell/rebalance their portfolio. Mutual funds are managed by portfolio managers who handle all of those administrative details for a fee, but an investor wanting to make those decisions for themselves will likely seek control of their portfolio by cutting out the third-party. How frequent an investor wants to do this demonstrates which strategy they are pursuing.

Two strategies investors can take are buy-and-hold and market timing. According to U.S. Bank (2020), a buy-and-hold strategy is a “passive, long-term investment strategy that creates a stable portfolio over a long period of time to generate higher returns.” A passive investor will only periodically reevaluate their portfolio, ignoring short term losses for more favorable gains in the long term. A much more active investor participates in market timing, or closely following the market to try and identify bull or bear trends. These investors are seeking above-average returns in an attempt to build wealth quickly.

A recent academic article published by Philip Newall and Leonardo Weiss-Cohen highlights the correlation between investor attributes and beliefs to holding strategies. “The two main strands of financial economics,” they write, “both recommend that the average investor should rarely buy and sell stocks, known collectively as ‘trading’” (Newall et al., 2022). Over time, research has found that long-term, buy-and-hold strategies consistently outperform market timing. By investing for the long term, an investor is playing a positive sum game- as a company performs well, profits increase, thereby allowing the company to pass those returns on to investors in the form of dividends or stock price appreciation.

When an investor is trying to time the market, they believe that the market is somehow inefficient; that the current price of an asset doesn’t fully reflect its value. By consistently trying to buy at a low and sell at a high, the investor has to be right twice in order to be successful. Newall’s research has found high frequency trading to be more of a zero-sum game, where no wealth was actually created but instead redistributed from the investor who was wrong to the investor who was right.

According to a twelve-year timespan of trading data in Newall’s research, high frequency traders were profitable only 5% of the time. While these traders earn above market returns, the chances of success do not favor the average investor. Long-term investing, on the other hand, leads to an average profitability of 10% annually. In terms of investor attributes, Newall found that long-term traders were patient and objective and often focused more on strategic analysis. High frequency traders, however, were overconfident, impulsive, and sensation seeking.

One valid concern raised by Newall’s research is the gamification, or “gamblification,” of stock trading, and just how relatable high frequency trading is with gambling. Casino gambling, for example, does not favor the average better in the long term. Significant investments are made by the casinos to get customers to stay longer, knowing full well that a gambler is more likely to lose the longer they play. It is also a zero-sum game- either you win or the house wins.

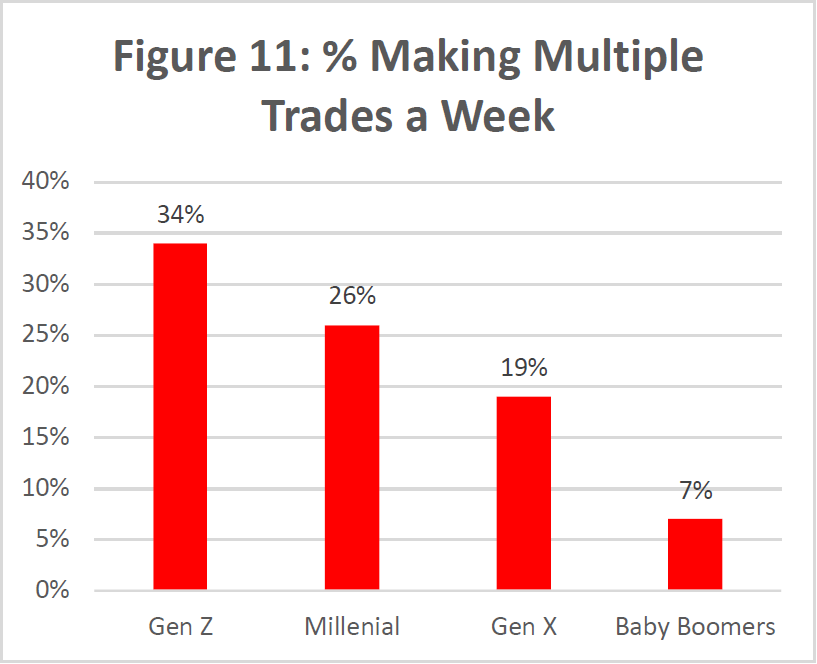

Furthermore, gamblers and high frequency traders have demonstrated similar behavioral patterns. Not only are their attributes similar in terms of overconfidence and sensation seeking but Newall also found that, “People experiencing gambling-related harm usually show signs of behavioral dependence, in that they spend more time engaging in gambling and thinking about gambling than they would prefer” (Newall, 2022). This level of “gambling-related harm” isn’t far off from Gen Z, wherein they’re not only spending the most time researching investments but they’re also the age category making the most trades a week (see Figure 11).

Figure 11: % Making Multiple Trades a Week

Data source: https://www.nasdaq.com/docs/etps-empoweringnext- generation-of-investors

Even though research has shown that frequent trading is correlated with worse returns, Gen Z are preferring it over a buy-and-hold strategy (Bonaparte, 2010). Part of this reason may be due to the trading platforms they use. Many of the trading apps such as Robinhood and Publix use gamification elements to increase investor activity; anywhere from confetti drops to notifications on trendy stocks. These platforms make money through order batch processing, which is contingent on having a high volume of trades. Using Robinhood is a lot like walking through a casino floor room— the flashing lights, dinging sounds, and free drinks for those at the table are meant to entice you to play more.

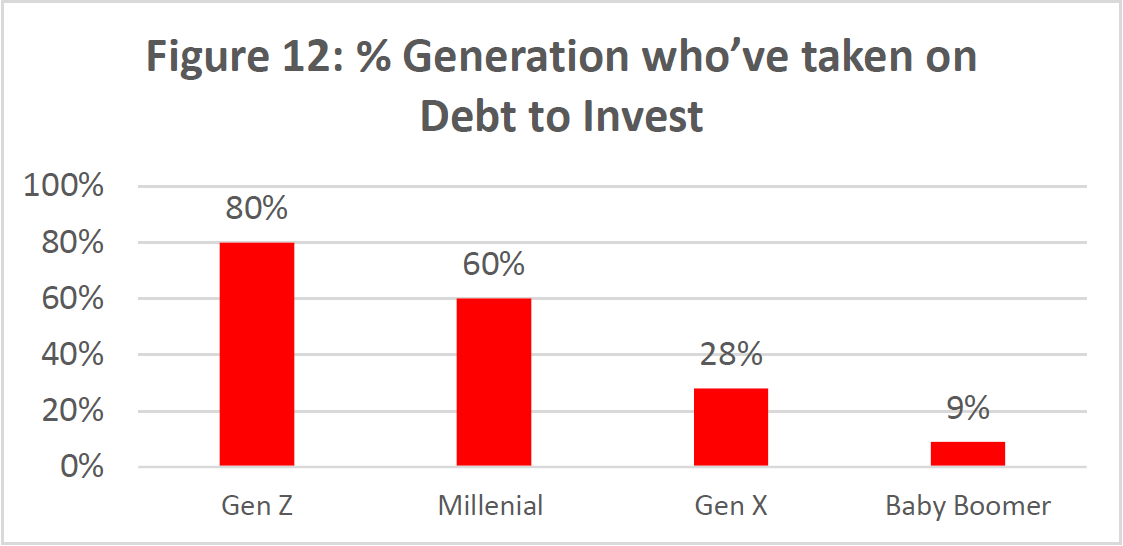

As despicable as it is to lose a lot of money at a casino, it’s even worse when that money was borrowed. According to a MagnifyMoney survey of over 2,000 respondents, approximately 80% of Gen Z investors have taken on debt to invest (Evans, 2021). While this is followed closely by millennials at 60%, it then drops down significantly to 28% for Gen X and 9% for Baby Boomers (see Figure 12). Of those who took on debt to invest, 46% claimed they’ve borrowed $5,000 or more, 22% borrowed less than $1,000, 32% borrowed $1,000 to $4,999, 26% borrowed $5,000 to $9,999, and 20% borrowed $10,000 or more (Evans, 2021).

Figure 12: % Generation who’ve taken on Debt to Invest

Data source: https://www.magnifymoney.com/news/debt-to-invest/

Not only are younger generations making risky investment decisions but they’re also using debt to do so. This compounds the issue of experiencing average negative profits of high frequency traders. Investors will not only have to pay back the sum they lost in investing but they will also have to pay interest on it too, interest that likely started from when they first took on the debt.

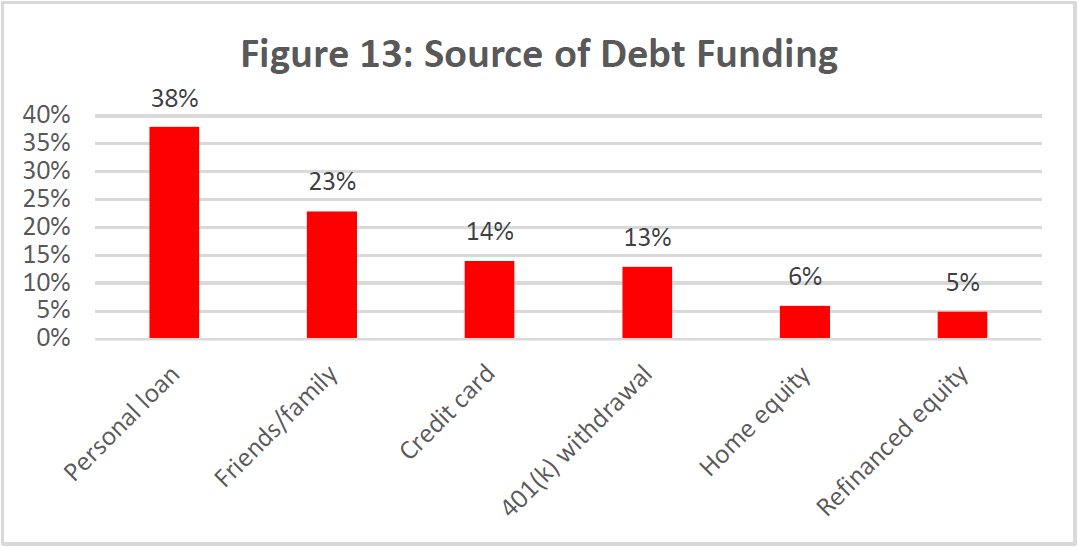

Traditional financial literacy would advise one to pay off current debts before investing, but in this situation, investors are actually taking on debt to invest. MagnifyMoney also went into greater detail to find the sources of debt funding as well as the primary purpose for taking on that debt (Figures 13 & 14). Of those who took on debt to invest, personal loans were the largest category at 38%, followed by friends and family at 23% and credit cards at 14%.

Figure 13: Source of Debt Funding

Data source: https://www.magnifymoney.com/news/debt-to-invest/

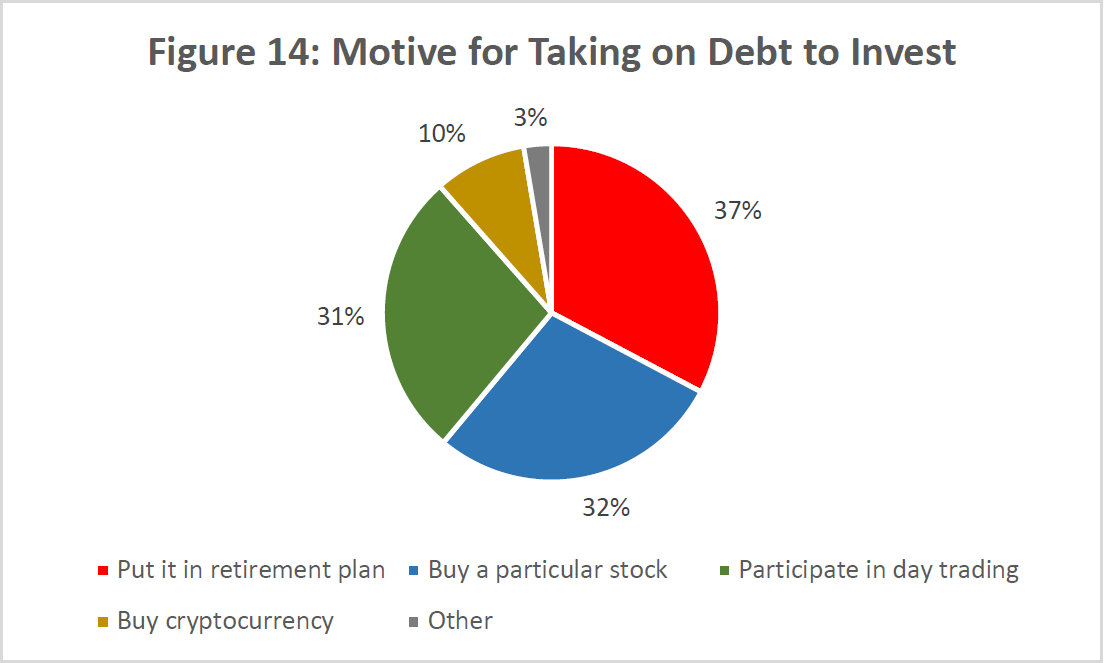

While many are taking on debt to invest, fortunately, the largest proportion of them are doing it for a good reason. 37% of those who took on debt to invest put it in a retirement plan, anticipating a higher, longer-term return than what the interest might be worth. However, 32% took on debt to buy a particular stock and 31% did so in order to participate in day trading.

Figure 14: Motive for Taking on Debt to Invest

Data source: https://www.magnifymoney.com/news/debt-to-invest/, respondents were allowed to select more than one answer if applicable.

Conclusion

Through the use of several different studies and research databases, we were able to find that younger investors prefer a more DIY approach to investing and are willing, knowingly or unknowingly, to bear the risks of doing so. While all age groups main motivation for investing is to be able to afford a comfortable retirement, Gen Z and millennials are also motivated to elevate their financial status and become wealthy.

Contrary to their older parents or grandparents, young investors are using untraditional sources of information to learn about investment opportunities. While they find financial advisors the most credible, they’re also the least likely to use them. As it turns out, a study by Ernst & Young found that “70% of women and millennial/Gen Z investors will likely fire their family’s advisors,” especially as they begin to inherit the trillions of dollars’ worth of portfolios currently being held by their Baby Boomer grandparents (Case, 2021).

Rather than using financial experts, young investors instead rely primarily on social media and their own analysis/perception of the market when investing. Regardless, younger generations want to take an active approach in managing their financial futures, evident by the extent of time they spend studying potential investments as well as how frequently they check their portfolios.

While open mutual funds are simple to access and participate in, it isn’t enough for Gen Z or millennials. These investors want to make asset allocation decisions for themselves and are often persuaded to do so by emotional reason as opposed to logic. Currently, the largest trading platform for Gen Z, Robinhood, is set up to take advantage of their emotions and encourage more frequent participation (Newall, 2022).

In conclusion, these motivations and sources of information are encouraging young investors to participate in untraditional or alternative assets such as cryptocurrency. While they’re financially aware of more investment opportunities, they also defy traditional financial principles by taking on debt to invest. Their high-risk tolerance is also illustrated by their high participation in options trading at two times more than the average rate (NASDAQ, 2022). Options trading is something that is recommended only for sophisticated investors who know what they’re doing, many of whom use complex hedges to limit their losses.

Do these findings suggest that young investors are investing without merit at all? Is all of their asset allocation or motivations for investing bad? Not necessarily. While Gen Z and millennials are the most likely to frequently trade, they’re also doing the most research beforehand.

Based on a millennial report filed by the Bank of America utilizing 1,900 survey respondents, one in four millennials have more than $100,000 in their savings accounts (Pepler, 2021). That same study found that millennials started saving for retirement at the age of 24 as opposed to 30 for Gen X and 33 for Baby Boomers. Their generation was also the most likely to know and understand how capital gains taxes work when they first started investing (Personal Capital, 2021).

In the end, Gen Z and millennial investors want a better financial future for themselves, and they’re starting at a younger age to do so. While everyone wants to pick the next Apple or Tesla stock, this generation also wants to be financially independent. Based on the aforementioned Bank of America study, 74% of millennials frequently check their account balances, 55% track expenses, 46% pay their credit card bills in full, 31% plan a budget and 34% of those who do actually stick to it (Pepler, 2021).

While gamification elements on trading platforms remains a concern for the Securities and Exchange Commission (SEC), further research has found that investment experience has a negative effect on risk tolerance (Beyoud, 2022). A study conducted by Surabaya State University in 2019 found that while “financial literacy has a positive effect on risk tolerance, investment experience has a negative effect on risk tolerance” (Kusumaningrum, 2019). Their statistical research and findings demonstrate that financially literate investors are more likely to understand the risks of certain assets than inexperienced ones and prepare better by mitigating some of those risks. Investment experience, on the other hand, decreases an investors risk tolerance- especially if that investor learns first-hand just how much risk is involved with investing.

With a much larger proportion of young people investing than ever before, their behavior isn’t untypical of an inexperienced investor. Research has found that while they stock pick now, the more losses they incur the more likely they’re going to seek for diversification. Perhaps similar to how a gambler knows ‘when to walk away,’ it will be interesting to see how Gen Z and millennial risk tolerances change as they gain investment experience.

In the end, the younger generation is a force to be reckoned with. Innovation and social media have prompted their participation in investing, and many of them are here to stay. The current United States population over 65 years of age is expected to increase to 21.6% by 2040, and as these Baby Boomers begin liquidating their portfolios for retirement, the markets will be even more influenced by the rising generations (U.S. Department of Health and Human Services, 2020).

The best thing for us to do, as an investor or not, is to be informed. The world is polluted with information, good and bad, and being able to wade through the muck and skepticism will make all the difference moving forward.

References

6 reasons to buy-and-hold stocks for long-term investing: U.S. bank. 6 Reasons to Buy-and-Hold Stocks for Long-Term Investing | U.S. Bank. (2020, July 28). Retrieved March 26, 2023, from https://www.usbank.com/investing/financial-perspectives/investing-insights/buy-and- hold-long-term-investment- strategies.html#:~:text=Buy%2Dand%2Dhold%20is%20a,them%20despite%20any%20ma rket%20fluctuation.

AFREPRELAX News. (2022, September 3). How much time do people spend on social media and why? Forbes India. Retrieved March 24, 2023, from https://www.forbesindia.com/article/lifes/how-much-time-do-people-spend-on-social- media-and- why/79477/1#:~:text=Generation%20Z%20%E2%80%94%2016%2D24%20year,and%20 40%20minutes%20for%20men.

Amadeo, K. (2022, March 28). 1920s Economy: What Made the Twenties Roar. The Balance. Retrieved March 23, 2023, from https://www.thebalancemoney.com/roaring-twenties- 4060511#:~:text=One%20reason%20for%20the%20boom,the%20remaining%2080%2D9 0%25.

Anderson, S. (2021, January 26). Stocks then and now: The 1950s and 1970s. Investopedia. Retrieved March 23, 2023, from https://www.investopedia.com/articles/stocks/09/stocks- 1950s-1970s.asp

Beattie, A. (2023, January 30). Wall street history: Railroads and Rockefeller. Investopedia. Retrieved March 23, 2023, from https://www.investopedia.com/financial-edge/0510/wall- street-history-railroads-and- rockefeller.aspx#:~:text=The%20railroads%20were%20among%20the,lines%20would%2 0follow%20the%20tracks.

Bell, L. (2021, November 29). Evolution & History of Investing. Ally: Do It Right. Retrieved March 23, 2023, from https://www.ally.com/do-it-right/investing/evolution-and-history-of- investing/

Beyoud, L. (2022, July 19). Trading ‘gamification’ is huge concern, sec enforcement chief Gurbir Grewal says. Bloomberg.com. Retrieved March 26, 2023, from https://www.bloomberg.com/news/articles/2022-07-19/trading-gamification-concern-for- sec-enforcement-chief-says#xj4y7vzkg

Bonaparte, Y., & Cooper, R. (2010, November 17). Rationalizing trading frequency and returns.

National Bureau of Economic Research. Retrieved March 26, 2023, from https://www.nber.org/system/files/working_papers/w16022/w16022.pdf

Boutté, C. (2022, June 4). I lost over $3,000 by following bad investing advice on YouTube, but it taught me an important lesson. Personal Finance. Retrieved March 26, 2023, from

https://www.businessinsider.com/personal-finance/lost-money-following-bad-investing- advice-youtube-2022-6

Caporal, J. (2021, August 3). Gen Z and millennial investors: Ranking the most used, trusted investing tools. The Motley Fool. Retrieved March 23, 2023, from https://www.fool.com/research/gen-z-millennial-investors-tools/

Case, J. (2021, November 18). Millenials and Gen Z are a growing force in investing. The market needs to catch up. Fortune. Retrieved March 23, 2023, from https://fortune.com/2021/11/18/millennials-genz-investing-markets-wealth-transfer/

CFA Institute. (2018, October). Uncertain futures: 7 myths about millennials and Investing – CFA Institute. FINRA Investor Education Foundation. Retrieved March 23, 2023, from https://www.cfainstitute.org/-/media/documents/support/advocacy/1801081-insights- millennials-and-investing-booklet.ashx

Cook, A. (2022, March 29). Every generation wants to retire comfortably. MagnifyMoney. Retrieved March 25, 2023, from https://www.magnifymoney.com/news/investing-by- generation-survey/

Evans, J. R. (2022, June 7). 80% of gen Z investors took on debt to invest. MagnifyMoney. Retrieved March 23, 2023, from https://www.magnifymoney.com/news/debt-to-invest/

Federal Reserve, Distribution of Household Wealth in the U.S. since 1989 (2022). Retrieved March 23, 2023, from https://www.federalreserve.gov/releases/z1/dataviz/dfa/distribute/chart/#quarter:126;series:Corporate%20equities%20and%20mutual%20fund%20shares;demographic:age;population:7;units:levels;range:1989.3,2021.1.

Hartmans, A. (2022, October 3). If you bought EMAX crypto tokens when Kim Kardashian promoted them on Instagram, you’d have lost over 95% of your money by now. Business Insider. Retrieved March 30, 2023, from https://www.businessinsider.com/kim-kardashian- crypto-emax-ethereummax-sec-promotion-value-plummeted-2022-10

Hasso, T., Muller, D., Pelster, M., & Warkulat, S. (2021). Who participated in the GameStop frenzy? Evidence from brokerage accounts. Finance Research Letters, 43, 1–16.

Hawkins, L. E., Versace, C., & Abssy, M. (2022, March 31). Gen Z: What to know about the next generation of investors. NASDAQ. Retrieved March 23, 2023, from https://www.nasdaq.com/articles/gen-z%3A-what-to-know-about-the-next-generation-of- investors

How to protect your 401(k) from a stock market crash? Beagle. (n.d.). Retrieved March 24, 2023, from https://meetbeagle.com/resources/post/how-to-protect-your-401-k-from-a- stock-market- crash#:~:text=While%20bonds%20don’t%20return,from%20a%20stock%20market%20cra sh.

Kusumaningrum, T. M., Isbanah, Y., & Paramita, R. A. S. (2019). Factors affecting investment decisions: Studies on young investors. International Journal of Academic Research in Accounting, Finance and Management Sciences, 9(3). https://doi.org/10.6007/ijarafms/v9- i3/6321

Library of Congress. (n.d.). Wall street and the stock exchanges: Historical resources. Stock Exchanges – Wall Street and the Stock Exchanges: Historical Resources – Research Guides at Library of Congress. Retrieved March 23, 2023, from https://guides.loc.gov/wall-street- history/exchanges#:~:text=American%20Stock%20Exchange&text=Founded%20by%20th e%20National%20Association,trading%20for%20over%202%2C500%20securities.

Macheel, T. (2022, May 2). Warren Buffett gives his most expansive explanation for why he doesn’t believe in bitcoin. CNBC. Retrieved March 25, 2023, from https://www.cnbc.com/2022/04/30/warren-buffett-gives-his-most-expansive-explanation- for-why-he-doesnt-believe-in- bitcoin.html#:~:text=Despite%20a%20shift%20in%20public,produce%20anything%2C% E2%80%9D%20Buffett%20said.

Millennials, Gen Z and the Coming “Youth Boom” Economy. Morgan Stanley. (2019, January 25). Retrieved March 24, 2023, from https://www.morganstanley.com/ideas/millennial- gen-z-economy.html

Mint, T. R. (2022, March 16). Gen Z Investment Report. LinkedIn. Retrieved March 24, 2023, from https://www.linkedin.com/pulse/royal-mints-gen-z-investment-report-the-royal-mint/

Morning Consult. (2022, March). ETPS are empowering the next generation of investors – NASDAQ. NASDAQ. Retrieved March 23, 2023, from https://www.nasdaq.com/docs/etps- empowering-next-generation-of-investors

Newall, P. W., & Weiss-Cohen, L. (2022). The gamblification of investing: How a new generation of investors is being born to lose. International Journal of Environmental Research and Public Health, 19(9), 5391. https://doi.org/10.3390/ijerph19095391

Pepler, A. (Ed.). (2020, December). Winter 2020 Better Money Habits® Millennial Report. Retrieved March 24, 2023, from https://about.bankofamerica.com/content/dam/about/report-center/bmh/2020/2020-bmh- millennial-report.pdf

Sweney, M. (2022, October 3). Kim Kardashian to pay $1.26m to settle crypto charges. The Guardian. Retrieved March 30, 2023, from https://www.theguardian.com/lifeandstyle/2022/oct/03/kim-kardashian-settle-crypto- charges-instagram-post#:~:text=Kardashian%20asked%20her%20then%20220,into%20crypto%3F%3F%3F%3F%E2%80%9D&text=The%20post%2C%20which%20featured%20the,how%20to%20 buy%20the%20tokens.

Ultra-Wealthy Risk Tolerance. (2014). Spectrum High Net Worth Advisor Insights, 10(10), 2–3.

United States Department of Health and Human Services. (2021, May). 2020 Profile of Older Americans. ACL administration for Community Living. Retrieved March 26, 2023, from https://acl.gov/sites/default/files/aging%20and%20Disability%20In%20America/2020Profi leolderamericans.final_.pdf

US Census Bureau. (2021, December 16). Bicentennial edition: Historical statistics of the united states, colonial times to 1970. Census.gov. Retrieved March 23, 2023, from https://www.census.gov/library/publications/1975/compendia/hist_stats_colonial- 1970.html

Vise, D. A. (1989, December 31). The stock market from the roaring ’80s to the sober ’90s. The Washington Post. Retrieved March 23, 2023, from https://www.washingtonpost.com/archive/business/1989/12/31/the-stock-market-from-the- roaring-80s-to-the-sober-90s/8f5858ec-18eb-4eb0-a822-3ba2bc2c0cdf/

Weller, C. E. (2002, April 10). Learning lessons from the 1990s: Long-term growth prospects for the U.S. Economic Policy Institute. Retrieved March 23, 2023, from https://www.epi.org/publication/webfeatures_viewpoints_l-t_growth_lessons/

Winkleman, C. S. A., Santamaria, C., & Winkleman, A. (2022, November 1). The graphic truth: 50 Years of US inflation vs interest rates. GZERO Media. Retrieved March 23, 2023, from https://www.gzeromedia.com/the-graphic-truth-50-years-of-us-inflation-vs-interest-rates