Social and Behavioral Science

130 Sustainable Support for America’s Children: The Expanded Child Tax Credit of 2021 and the Pressing Need to Implement a Bipartisan, Long-Term Child Allowance Policy in the United States

Jackson Frank Jowers

Faculty Mentor: Thomas Maloney (Political Science, University of Utah)

ABSTRACT

The United States has a vested interest in providing support for families raising children. Over the past 25 years, the country has used a tax code provision known as the Child Tax Credit (CTC) to provide financial assistance to parents raising children. This paper presents a synthesis of relevant political and academic discourse on child tax credits and allowances over the past 25 years and offer a sampling of potential paths forward for the policy in the United States. The research affirms that the United States should focus its efforts on converting to a fully refundable, simple-to-navigate, and monthly federal child allowance to maximize its return on investment for American families.

Academic understanding of child poverty’s detrimental and long-term effects is well documented. Research links growing up poor to low academic achievement, school dropout, abuse and neglect, and developmental and behavioral issues (Nikulina et al., 2011). Children who live in poverty are more likely as adults to develop and die earlier from cardiovascular disease and type II diabetes. Studies show that adverse health impacts from these early social determinants are biologically embedded, meaning that improved circumstances in adulthood only moderately correct the issues (Raphael, 2011). In 2008, economists estimated that child poverty costs the United States $500 billion a year, reduces productivity and economic output by 1.3 percent of GDP, raises crime, and increases health expenditure (Holzer et al., 2008).

The welfare system should be structured in a way that supports, not misses, those that are dedicated workers, devoted parents, and valuable contributors to their communities. Unfortunately, actually obtaining government benefits can be like a full- time job for many people, which creates the opposite effect of what a means-tested social welfare system is supposed to accomplish — providing a safety net while encouraging work and strong families.

Reforming or replacing the Child Tax Credit is a great place to start. Children who grow up in poverty face poorer educational, health, and career outcomes than their middle-class and wealthy peers regardless of their innate curiosity, intelligence, and drive. There is bipartisan momentum behind expansion and simplification of the Child Tax Credit, including proposals that include transforming the tax credit into a monthly child allowance.

The United States should convert the Child Tax Credit into a child allowance policy because such a change would provide more sufficient financial support and more consistent and predictable income for families and children, and it would be more easily and effectively administered by federal agencies. An intelligent and informed replacement of the Child Tax Credit with a child allowance policy can boost the well- being of American families, particularly those that face the greatest barriers to the American Dream. The prospect of raising a child will become less daunting, and parents will be incentivized and empowered to contribute to society both at work and at home. Children will be better equipped to thrive and reach their potential. A well-designed and administered benefit should stimulate both economic growth and citizen happiness.

First, this paper analyzes the history of the Child Tax Credit in the United States with a specific focus on the short-lived Expanded CTC that came in response to the coronavirus pandemic. Next, this paper will attempt to analyze the socioeconomic effects of child allowance policy choices, discussing the scale of need for and use of funds by parents as well as impacts on fertility rates. Afterwards, the paper will explore possible solutions by analyzing child allowance programs in wealthy countries around the world, using historical and contemporary political discourse to analyze ideological perspectives and approaches to the CTC and child and family policy, and breaking down currently pending CTC proposals among thought leaders and legislators in the United States.

Finally, it will conclude with the author’s perspective on three key principles to guide the design and implementation of a permanent federal child allowance program in the United States.

HISTORY OF THE CHILD TAX CREDIT

The Child Tax Credit: 1997-2020

The Taxpayer Relief Act of 1997, passed by a Republican-controlled Congress with bipartisan support and signed into law by President Bill Clinton, reduced many federal taxes and introduced several new tax credits (Crandall-Hollick, 2021). Notable provisions included an 8% reduction in the top marginal long-term capital gains rate, the establishment of Roth IRAs as retirement accounts exempt from capital gains taxes, and the introduction of the Child Tax Credit.

The Child Tax Credit initially provided a $400 benefit for each child under age 17 but was increased to $500 in 1998. The credit was applied annually as part of an individual’s tax return. The credit was nonrefundable, only decreasing existing federal tax liability. If an individual did not owe any more taxes, the government did not return the leftover credit as a cash benefit. The credit phased out for taxpayers with incomes over $110,000 (married filing jointly) or $75,000 (head of household or single).

The Economic Growth and Tax Relief Reconciliation Act of 2001 increased the credit to $600 per child and scheduled stepped increases to $1,000 per child by 2010 (subsequent legislation accelerated these increases and reached $1,000 per child in 2004). The legislation also made the credit semi-refundable: lower-income taxpayers with more than $10,000 of earned income could receive part or all of the child tax credit as a cash benefit. Known as the “refundability threshold,” the $10,000 limit was adjusted annually for inflation. In 2009, President Barack Obama signed the American Recovery and Reinvestment Act in response to the financial crisis. This act temporarily expanded the refundability of the Child Tax Credit by reducing the refundability threshold to $3,000 for 2009 and 2010. This change was made permanent through later acts of Congress.

In 2017, a Republican-dominated Congress passed The Tax Cuts and Jobs Act, most notable for its sweeping reductions in federal taxes, which included a variety of modifications to the Child Tax Credit. The act increased the maximum benefit to $2,000 and decreased the refundability threshold to $2,500. The phase-out threshold was raised significantly to $400,000 for married joint filers and $200,000 for head of household or single filers. By making the single filer threshold exactly half of the married threshold, Republican lawmakers intended to address a tax disincentive for marriage, a longstanding conservative priority in tax reform. The act required that taxpayers include a work- authorized Social Security Number when filing for the credit. Congress made the provision with the intent of limiting fraudulent claims, but in effect it may also make the credit less accessible to low-income families. Finally, the legislation created a temporary

$500 per dependent nonrefundable credit for children not eligible for the child tax credit.

Lessons Learned

The legislative history of the Child Tax Credit shows lawmakers continually coming back to a few key questions. How large of a benefit should the CTC be? Should the credit be refundable, and if so, should it be fully or partially refundable? Should filers be required to earn income in order to qualify for the CTC, and if so, how much should they make? At what income level should the credit phase out? Answers to these questions generate the foundational structure of the child tax credit, which creates important impacts on children’s lives.

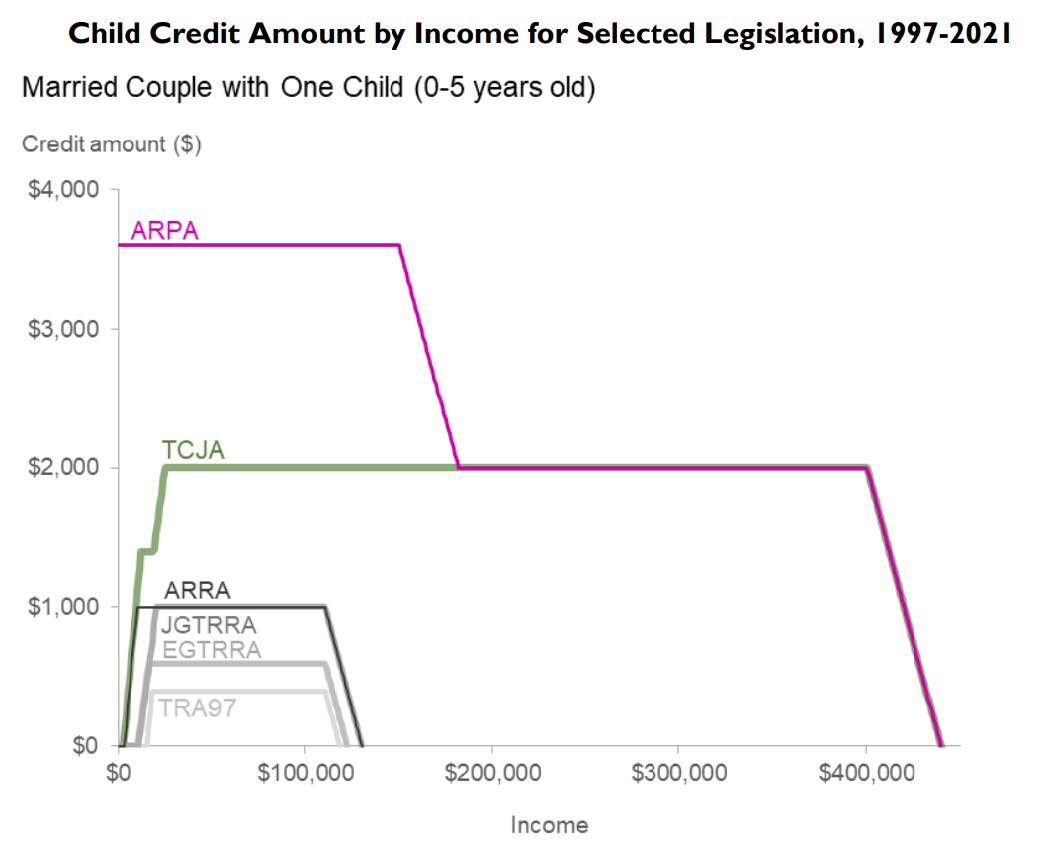

Throughout the Child Tax Credit’s legislative history, initially temporary modifications to increase the scope and size of the credit are generally extended and made permanent in subsequent years as the Child Tax Credit proves to be successful, effective, and popular. Figure 1 below from the Congressional Research Service shows the evolution of the Child Tax Credit over time with respect to a married couple with one child under 5 years old. The Y-axis shows the credit amount received and the X-axis shows household income, and the various lines show the policies enacted over the period.

Figure 1

Note. From Crandall-Hollick, M. L. (2021). The Child Tax Credit: Legislative History.

Congressional Research Service, R45124. https://sgp.fas.org/crs/misc/R45124.pdf

The Expanded Child Tax Credit of 2021

The COVID-19 pandemic exacerbated already significant problems for low- income parents raising children. Widespread school closures created high social and economic costs, including stymied academic progress, lack of access to childcare and nutritious food, and social isolation.7 In response, the American Rescue Plan Act of 2021

created the expanded Child Tax Credit. Simply calling it the expanded Child Tax Credit is misleading, however, as the existing tax credit program was converted into a child allowance program.

The government increased the Child Tax Credit from $2,000 per child to $3,000 per child for children over the age of six and $3,600 for children under the age of six. The credit was paid in monthly increments of $250 or $300 rather than an annual lump sum. It was fully refundable, meaning that families at low income levels that do not have outstanding tax liability would receive the credit as a direct cash transfer. The expansion raised the qualifying age limit from 16 to 17 and adjusted the income phase-out threshold down to $150,000 for joint filers and $112,500 for single or head of household filers.

After that income level, the credit returned to the previous level as established in 2017 by the Tax Cuts and Jobs Act. The top line in Figure 1, in pink, is the American Rescue Plan Act. Note that at an income level of $0, a family qualified for the benefit, a first for any version of the legislation.

At the time of this writing, Congress has been unable to find a compromise to renew the CTC expansion for 2022 and beyond. The CTC has reverted to the previous iteration: only $2,000 per child without full refundability and revoked qualification for 17-year-olds. In the absence of the monthly cash payments guaranteed by the expanded credit, about 3.7 million more American children are living in poverty, according to the Center on Poverty and Social Policy, at Columbia University (Parolin et al., 2022).

CHILD ALLOWANCE POLICY OVERVIEW

Socioeconomic and Health Impacts

In 2020, researchers conducted a longitudinal study on the effects of the Child Tax Credit with a nationally representative sample of mothers and their biological children. Some of the most significant findings included that children suffered fewer injuries requiring medical attention and dealt with fewer behavior problems due to CTC payments. Alleviating financial strain through the policy also decreased child abuse and youth violence. However, the researchers found that these effects were present “only when it was partially refundable (i.e., mothers could receive a tax refund for a portion of the CTC that exceeds their tax liability) for families making as little as $3000 a year” (Rostad et al., 2020). These findings highlight the critical nature of refundability for the most vulnerable parents and children. The authors concluded, “Tax credits like the CTC have the potential to alleviate financial strain among families, and consequently, may have impacts on injury and behavior problems.” While direct financial support cannot cure all social ills for low-income families, this study provides evidence that alleviating financial strain can lead to positive impacts on health and overall wellbeing.

Earlier this year, a major study found that a predictable, monthly unconditional cash transfer given to low-income families may have a causal relationship with improved infant brain activity. By creating a more auspicious financial situation for their families, children’s brain activity adapted in ways associated with the development of critical cognitive skills (Troller-Renfree et al., 2022).

In 2007, Mayor Mike Bloomberg implemented Opportunity NYC, a program giving cash to low-income families in New York City meeting specific requirements, including regular school attendance and doctor visits. The city transferred an average of $8,700 to each participating family over three years, and the results were encouraging. Families faced reduced food scarcity and financial worries while increasing their savings and health insurance. Still, there were no significant positive increases in educational outcomes. NYU professor Lawrence Aber explained this underwhelming result by asserting that the program should have been longer-lasting and rewarded more measures of academic improvement. Overall, however, the program’s results were impressive, and more experiments of a similar nature could generate a better understanding of best practices and generate momentum for a long-term policy solution (Chang & Madrick, 2016). At the very least, the program should pique policymaker interest to continue to experiment with cash transfer welfare programs at local levels.

Impacts on the Economy

The Niskanen Center, a think tank, estimated that the CTC expansion would boost consumer spending by $27 billion in rural areas, generating $1.9 billion in revenues from state and local sales taxes (Hammond, 2021). In a report, they wrote “the CTC expansion provides larger benefits to states with lower average incomes and larger average family sizes, helping support access to community-based child care.” The benefits particularly extend to rural communities, who receive a “substantial injection of relative purchasing power equivalent to 1.35% of non-metro GDP” from an expanded CTC. These result in a “multiplier effect,” meaning that a dollar injected into the program results in more than one dollar of economic benefit as that dollar circulates through the economy.

Policymakers must consider these benefits when deciding the size of child allowance benefits. However, as we have seen in recent months, too much government stimulus can contribute to inflationary pressures. Leaders must take an empirical and level-headed approach to balancing these competing considerations.

Economists at Columbia University argued that permanently converting the Child Tax Credit into the expanded Child Tax Credit would cost roughly $100 billion but generate about $800 billion in benefits to society. Specific significant factors in this estimation include increased future earnings for children, decreased involvement with child protection and criminal justice services, and improved children’s and parents’ health outcomes (Garfinkel et al., 2021).

Estimating Need

The cost of raising a child must be understood to determine the proper size of the credit. Debates on the Child Tax Credit have primarily moved from a question of kind (should the United States provide benefits to families?) to a question of degree (how large should the benefit be, and who should qualify?). Having a Child Tax Credit is popular among legislators and voters on both sides of the aisle, and there exists no serious movement to abolish the credit among lawmakers. Both Republicans and Democrats have led efforts to expand the credit in the past. Ultimately, Congress must decide how much and for whom the government should bear the cost of raising children.

Researchers can use various methods to attempt to measure the cost of raising a child. Martin Browning of McMaster University highlighted that necessary considerations include how children affect the expenditure patterns of a household, how much income a family with a child needs compared to a childless family, and how much parents actually spend on their children (Browning, 1992). A few notable estimates are included below as a glimpse of studies of the cost of raising children.

The U.S. Department of Agriculture has provided estimates of expenditures on children from birth through age 17 since 1960. Their method includes allocating child- specific expenses directly to children while using findings from Federal surveys on children’s budget shares to analyze children’s contributions to other costs. In 2015, the USDA estimated that it costs an average of $233,610 for a middle-class household to raise a child to age 18, or about $13,000 per year. For those making under $59,200 annually, annual expenditures ranged between $9,330 and $9,980, while those making above $107,400 spent between $19,380 to $23,380 per year per child. The study also notes that ‘economies of scale’ exist as more children are introduced to the family — sharing rooms and passing down items like clothes, toys, and books makes each successive child less expensive to raise than the one before (Lino, 2015).

In Christopher A. Sarlo’s paper entitled The Cost of Raising a Child, he argues that “prevailing cost estimates have a distinct middle-class bias and do not reflect the reality of raising children in lower income and newer immigrant households. There is a concern that such estimates send a clear message to lower income families that they really cannot afford children and, perhaps, shouldn’t have any.” His report concludes that an annual payment $3,000 to $4,500 would be sufficient for the bare necessities and basic costs necessary for a child’s healthy development (C. Sarlo, 2013).

A policy that provides more support to younger children than to older children is logical, as parents tend to have lower incomes when they first have children but will hopefully build savings over time. Structuring the policy in this way may also reduce barriers to younger people becoming parents.

Analyzing Use

Some decision-makers worry about the implications of providing any income support to low-income individuals without strings attached to the use of the money. Many think non-disabled individuals will use the extra influx of cash to avoid work, deepening their dependence on government aid. Senator Joe Manchin reportedly expressed concerns to Congressional colleagues that parents would use their expanded child tax credit payments to buy drugs (Shabad et al., 2021). It is worth analyzing the extent to which these concerns are valid.

The Brookings Institute utilized a probability-based online panel to survey a nationally representative group of 1,514 U.S. parents eligible for the credit, administered immediately before the they received their first CTC payments (Jabbari et al., 2021). As part of this study, participants were asked how they planned to use their CTC payments. Top responses included using the funds to build emergency savings (75%), paying routine expenses (67%), purchasing essential items for children (58%), purchasing more or better food (49%), starting or growing a college fund (42%), and paying for child activities (42%). Parents also noted that they would use the money for moving or making home improvements (32%), health care (29%), and child care (26%) expenses. Other uses included spending more time with children (20%), purchasing gifts or entertainment (20%), paying for tutors (7%), working less or changing jobs (6%), or sending their children to a different school (6%).

Comparing between income groups, a substantially more significant proportion of lower-income families planned on using their CTC for essential items, more and better food, and spending more time with their children than middle- and higher-income families. Brookings argued that these findings show that fears that the CTC will disincentivize work are “relatively unfounded,” given that only 6% of respondents planned on using the money to work less. Instead, they argued, the expanded CTC would alleviate poverty, increase social mobility, and promote financial well-being for both parents and their children.

Effects on Labor

Early results from studies of the expanded Child Tax Credit are promising. CTC payments have helped millions of parents and caregivers enter or stay in the workforce.20

A study by researchers at Columbia University found that real-world analysis of labor supply shows that the CTC did not have major negative employment effects that offset its documented reductions in poverty in 2021 (Ananat et al., 2021).

The Heritage Foundation, a conservative think tank, speaking of proposed Build Back Better social spending generally, raised these objections to the policy: “It overturns the foundations of the Clinton-era welfare reform, which required able-bodied recipients to work or prepare for work in exchange for cash benefits. Instead, the bill resurrects the long-failed policy of paying families not to work” (Rector & Hall, 2021). However, there is a growing consensus among researchers that cash transfers made without an explicit employment requirement tend to result in little to no change in labor participation, except for reductions in working hours for the elderly and some refugee groups (Baird et al., 2018).

Effects on Fertility Rates

The fertility rate of the United States reached a historic low in 2020 at 1.6 births per woman, well below the replacement level of roughly 2.1 births per woman (Fertility Rate, Total (Births per Woman) – United States, 2022). The rate had remained slightly above replacement level throughout most of the 1990s and 2000s before starting a gradual decline in 2007. Even before the outbreak of the coronavirus pandemic, bearing and raising children was made prohibitively costly for many prospective parents due to student loan debt, inflation, and wage stagnation. A low birthrate creates severe demographic challenges as it tasks a smaller group of young people with the burden of providing for and taking care of a growing group of aging people (Morgan, 2003).

The Archbridge Institute and the Harris Poll surveyed a representative sample of US adults on their plans for having children. The poll found that 55% of US adults under the age of 30 want to have a child, either biologically or through adoption, in the future. Among those who do not want to have a child, 46% cited their personal financial situation as influencing their decisions (Skiera, 2022). Unmet fertility occurs when the actual number of bearing children is greater or less than the number of children than a woman desires to have because society it too difficult or expensive. Research shows that direct child allowance payments lead to at least a slight increase in birthrates.

A landscape review of studies found a positive and significant price effect on overall fertility, with benefit elasticities around 1-2% (González & Trommlerová, 2021). For example, a child allowance in Spain led to a 3 percent increase in birthrates, and birthrates dropped 6 percent when it was canceled. Further, when the government introduced the benefit, abortions dropped by .15 daily abortions per 100,000 women, and increased by .37 daily abortions per 100,000 women when the benefit was removed.

Researchers at Columbia University found that financial incentives play a notable role in determining fertility decisions in France, with the evidence suggesting that an unconditional child benefit with a direct cost of 0.3% of GDP would raise total fertility by between 15.5% and 17.7% (Laroque & Salanié, 2005).

FINDING A SOLUTION

The Ideal World

Conservative and progressive values find an intersection in a child allowance policy. Many progressives see caring for low-income parents as a necessary function of the government, while many conservatives advocate for family values and decry what they frame as the dissolution of the family unit. Some prominent Republicans, including Senator Mitt Romney (R-UT), have called attention to the United States’ declining birthrate as a precursor to socioeconomic difficulty and declining influence on the world stage (Romboy, 2021).

A recent study into the conservative and liberal views of the ideal world generated insights that can help to dissect these ideological intricacies as they relate to the Child Tax Credit and family policy more generally. Researchers analyzed over 3.8 million tweets sent by more than 1 million Twitter users about the factors that constitute a good or bad society (Sterling et al., 2019). Liberals spoke significantly more often of social justice, global inequality, women’s rights, racism, criminal justice, health care, poverty, progress, social change, personal growth, and environmental sustainability. Conservatives referred to religious tradition, social order, controlled immigration, capitalism, and national symbols more often. The study also found common ground: liberals, moderates, and conservatives were equally likely to see economic prosperity, family, community, and the pursuit of health, happiness, and freedom as core pillars of the ideal society.

The three main conservative concerns about an expanded child allowance program are the burden on the already substantial federal deficit, the promotion of unstable families and single-parent households, and further reliance by low-income Americans on the welfare state.

Liberals and progressives tend to support increased help for the most vulnerable and needy in society. Equity and equality are fundamental values. The refundability portion of the expanded Child Tax Credit is a major appeal to these values — providing unconditional support for parents even if they do not receive a traditional income.

The Child Tax Credit can be designed and messaged so that the fundamental shared values of liberals and conservatives are reflected and emphasized. Some conservatives have concerns about a deteriorating social fabric due to changing gender and family roles and conduct expectations. The CTC can promote supportive, nurturing environments for children, resulting in increased stability in the home and, consequently, decreased risk for gang participation or involvement in the criminal justice system down the line. Noting the decrease in abortion rates other countries that have implemented such policies may resonate for some pro-life conservatives. Understanding and communicating the economic return on investment for the country from such a policy can also appeal to more capitalist-oriented conservatives who primarily value strong economic growth and promoting business interests.

Some aspects of the CTC should appeal to individuals all along the spectrum. Effective child allowance policy promotes better health and nutrition outcomes and increases economic mobility. However, decisionmakers must acknowledge and address a fundamental difference between the liberal and conservative views of the primary purpose of the child tax credit. Liberals see the child tax credit primarily as an anti-child poverty tool. Meanwhile, conservatives see the credit as a way to promote child-bearing and family values through primarily supporting working, middle-income families (Gleckman, 2022). The policy can do both, though trade-offs are inevitable. Finding a compromise, perhaps in some form of watered-down income or work requirement, or in tweaking phase-in and phase-out levels, will be difficult but not impossible. The values presented above of conservative and liberal views on the ideal world can serve as a starting point for political leaders and elected officials to use in designing and promoting a more effective expanded and reformed CTC that can get through Congress and be signed into law.

Child Allowances Around the Globe

Many wealthy nations employ a universal child benefit. Luxembourg provides the most generous child benefit at nearly $4,500 per year for two kids. Belgium, Austria, Germany, and Ireland all provide substantial benefits ranging from $2,000 to $3,000 per year per child. Policies vary based on priorities and the extent of other social programs.

France’s program, for example, is designed primarily to encourage higher birth rates — their child benefit is only available for families with two or more children (Matthews, 2016). The United Kingdom had a universal child benefit policy from 1999 until 2013. Now, Britons qualify for a Child Benefit of £21.80 per week for an eldest or only child and £14.45 per week for each additional child. The benefit is paid every four weeks. If filers have an annual income level above £50,000, the benefit begins to phase out, and it is no longer made available at an annual income level of £60,000 (Claim Child Benefit, 2014).

The United States can look just north to find an example of a country moving from a complex set of child support programs that included, among other things, benefits for hockey lessons, to a much more streamlined system of cash benefits. In 2013, a Trudeau-led Liberal government enacted the Canada child benefit (CCB) of $440 per month for each eligible child under the age of 6 and $370 per month for each eligible child aged 6 to 17 (Canada Child Benefit (CCB), 2021). The change has been popular among parents and helped reduce child poverty. However, some researchers, such as those at the Fraser Institute, argue that this program and others like it are woefully understudied and likely did not have as large an impact as politicians may assert (C. A. Sarlo, 2021).

Pending Proposals

The Biden administration and most congressional Democrats would like to see the expanded Child Tax Credit extended. In early 2022, five Democrat senators sent a letter urging the Biden administration to ensure the expanded CTC is a “centerpiece” of Build Back Better legislation (Bennet et al., 2022). They heralded the expanded CTC as “a signature domestic policy achievement of this administration” and “an overwhelming success.” The letter focused on the anti-poverty merits of the law, from reducing child poverty and hunger, particularly for children of color, to promoting economic growth in rural communities.

Public support for the expanded CTC varies from poll to poll. A Morning Consult and Politico poll in July 2021 found that only 35 percent of respondents said the expansion should “definitely” or “probably” be permanent. On the other hand, a survey from Data for Progress and Mayors for a Guaranteed Income found that 56 percent of voters support making the child tax credit expansions permanent (Schnell, 2021). The monthly payment aspect of the modified policy seems to be popular: three out of four respondents in one study preferred monthly payments rather than a lump-sum annual payment (Hamilton et al., 2021).

Analysts struggle to find explanations for the lukewarm public support shown for the expanded CTC — policies like lowering costs for prescription drugs and expanding Medicare are consistently more popular. Younger Americans, who are more likely to be parents receiving the credit, tend to approve of the expansion, while many older Americans do not. M.I.T. Social policy scholar Andrea L. Campbell suggested that older Americans may hesitate to support benefits that seem to threaten funding for programs that they rely on heavily, primarily Social Security and Medicare (Campbell, 2002).

Americans may also lump together the expanded CTC as a temporary pandemic program that has no use in a post-covid world, or some may see the full refundability as an unwelcome departure from the traditional means-tested welfare system in the United States. The tepid public response should be noted and analyzed. However, polling is an imperfect gauge of public sentiment, and there is plenty of ongoing research showing the vast benefits of a universal child allowance policy. The New York Times notes that the Affordable Care Act of 2010 did not become consistently popular until 2017 when President Trump and a Republican-held Congress attempted to repeal it (Philbrick, 2022).

With the Expanded Child Tax Credit set to expire at the end of 2021, Congressional Republicans and Democrats debated the best path forward. Most Democrats were in favor of making the expanded child tax credit permanent or at least extended into future years. Some Republicans were also in favor of a larger tax benefit, though the full refundability and lack of a work requirement were major sticking points for conservatives, including Senator Joe Manchin (D-WV), who as a conservative Democrat in a 50-50 Senate would be a major swing vote on any potential legislation, as has been shown in his thwarting of recent pushes by the Democratic coalition pass the $2 trillion social spending bill known as Build Back Better (Fram, 2021) and, later, to remove the filibuster in order to pass less restrictive federal voting laws (Hulse, 2022). Other conservatives have criticized the use of terminating or curtailing spending programs in the bill earlier than the close of the 10-year budget window, hiding the overall costs. This criticism is valid, though Democrats and Republicans alike have used similar accounting tricks to get a variety of spending bills through Congress palatably throughout history.

In February 2021, Senator Mitt Romney (R-UT) released the Family Security Act, marketed as a Republican alternative to the Expanded Child Tax Credit (Romney, 2021). The Family Security Act would replace the existing Child Tax Credit with a monthly cash benefit for families. The Social Security Administration would distribute $350 per month for children under age six and $250 per month for children under age eighteen.

The phase-out thresholds would remain at $200,000 for single filers (head of household status would be eliminated) and $400,000 for married joint filers. Notably, the benefit would be available to pregnant mothers four months prior to the child’s due date.

The bill consolidates a variety of federal policies that currently exist to support families, many of which Romney describes as ‘duplicative,’ into direct, monthly cash support for families. One notable change is a modification of the Earned Income Tax Credit (EITC), which is a somewhat complex mechanism for supporting low-income American families, designed to promote working and earning income (What Is the Earned Income Tax Credit (EITC)?, 2022). The EITC has come under scrutiny. In part because of the complexity of the EITC, a higher than average percentage of individuals with income below $25,000 are audited every year, as noted in a recent Government

Accountability Office (GAO) report (Tax Compliance: Trends of IRS Audit Rates and Results for Individual Taxpayers by Income, 2022).

Under the Family Security Act, the EITC would be simplified to a binary division between a household with dependents and households with no dependents, rather than varying the benefit based upon the number of dependents in the household. Though this change would negatively impact some families at certain income levels with certain numbers of dependents, the Family Security Act promises that no family will receive less money than before this change. The details on how that will be accomplished are scarce and will need to be clarified in future discussions. Still, this change may help simplify the tax filing procedure for low-income Americans and reduce IRS audits and improper payments among the lowest-income Americans.

Eliminating the head of household designation as a tax filing option is not necessarily the headlining feature of the plan, but it would be an impactful and controversial change. Conservatives have long advocated for eliminating “marriage penalties” in the tax code, arguing that policy decisions should support working families while encouraging marriage as a pathway to escape poverty (Roth, 2021). Head of household status is available to unmarried people who have a dependent and pay most of the costs of maintaining the household wherein they and the dependent live for more than six months in the year. In 2015, 22 million people filed as head of household. The status results in a variety of favorable tax preferences, most notably that lower tax rates apply to a greater share of income earned by heads of households compared to those who file as single (Eliminate or Modify Head-of-Household Filing Status, 2018). For example, the expanded Child Tax Credit began to phase out at income levels of $75,000 for single filers and $150,000 for joint filers but at an income level of $112,500 for head of household filers. For many families, these realities disincentivize marriage. However, as the National Women’s Law Center and others have argued, eliminating head of household status would negatively impact single parents and other unmarried people who are supporting dependents, particularly low- and middle-income people (Eliminating the Head of Household Filing Status Would Hurt Women, 2017).

Benefit cliffs (income levels where families no longer qualify for the credit) remain at the higher TCJA levels. To balance out the additional costs of the larger family benefits, the plan would eliminate the State and Local Tax Deduction (SALT), which Romney describes as “an inefficient tax break to upper-income taxpayers.” This is a valid criticism. Democratic support of the SALT deduction, even attempting recently to eliminate the deduction cap of $10,000 a year or raise it dramatically, is a strange outlier to the party’s general platform supporting higher taxes on the rich. In 2016, 77 percent of SALT deduction benefits went to those with incomes above $100,000; only 6.6 percent accrued to taxpayers making less than $50,000 per year (Bellafiore, 2021). The Brookings Institution called the SALT tax deduction “a handout to the rich” and argued that it should be eliminated, not expanded (Pulliam & Reeves, 2022). If Congress repealed the cap, 96 percent of the benefits would go to the top quintile (an average tax reduction of $2,640), 57 percent would benefit the top one percent (a cut of $33,100), and 25 percent would benefit the top 0.1 percent (a reduction of nearly $145,000) (T20-0182, 2020).

Romney argued that the plan would establish a firm national commitment to all of America’s families while cutting American child poverty by up to one-third and immediately raising nearly 3 million children out of poverty. While, on the surface, a plan to provide unconditional cash benefits to the parents of children seems antithetical to traditional fiscal conservatism, there are aspects of the plan that appeal to many in the Republican ranks. The unprecedented expansion of eligibility to include unborn children may appeal to pro-life conservatives. Eliminating the Head of Household filing option would remove the tax disincentive for marriage for parents raising children — the phase- out threshold would not be higher for single filers than for married filers. The proposal’s plans to reform and consolidate “antiquated” federal programs could also gain traction among fiscal conservatives.

The central sticking point with this plan for many Republican senators (and Senator Joe Manchin) is the lack of a work or income requirement for receiving the benefit. Because the plan is fully refundable, even those who do not receive an income are entitled to the Child Tax Credit. Senators Rubio (R-FL) and Lee (R-UT) offered a counterproposal in the form of an amendment to the Senate Budget Resolution to expand the Child Tax Credit. Their proposal would expand the Child Tax Credit while ensuring the credit does not go to individuals who are not working (Rubio et al., 2021). Senator Rubio said of the Biden Administration’s plans to make permanent the child tax credit, “This new Government Child Allowance scraps incentives for marriage, destroys the child-support enforcement system, and abandons requirements for work. We’ve seen the destructive consequences that follow when the government pays people not to work.” Senator Lee asserted, “To have a truly pro-family tax code, we must have a pro-growth and pro-worker tax code, creating monthly welfare payments under the Government

Child Allowance, however, will only disincentivize marriage and the responsibility of parents to provide for their families.”

MOVING FORWARD

A few principles should guide discussions of the future of the Child Tax Credit.

First, providing a child allowance is an investment with a high rate of return for domestic prosperity. Second, the Child Tax Credit must be easy to navigate for taxpayers and more efficient to administer for government agencies. Third, making the payments monthly and fully refundable are vital steps to ensure the positive impact of the program on children and families.

Priority One: Sufficient Support

First, providing a child allowance is an investment with a high rate of return for domestic prosperity. Congress should pursue the development of a policy targeted at supporting children, those in our society that are some of the most vulnerable but also have the most ahead of them, that generates a $7 overall return for every $1 spent. The benefit should be substantial — a baseline of $3,000 per year per child, with an additional benefit for children under six, seems to be an ideal and politically feasible place to start discussions.

There are two income benefits available for families that cannot find work or whose income is too low to qualify for work-related tax credits: the Supplemental Nutrition Assistance Program (SNAP) and the Temporary Assistance for Needy Families (TANF) program. SNAP provides a vital baseline of support for families with children, but expenses are limited to food purchases and cannot be used for other essential living expenses such as housing and utilities. TANF is a cash assistance program established as part of the welfare reform of 1996. Over time, its impact has dwindled as the program has not been sufficiently modernized: the number of families receiving cash assistance per 100 families in poverty has declined from 68 in 1996 to 23 in 2015 (Floyd et al., 2017). These programs are insufficiently supportive for low-income families, and a generous child allowance is needed to help children raised in these families avoid unfortunate life outcomes.

Priority Two: Monthly, Refundable

Second, making the payments monthly and fully refundable are vital steps to ensure the positive impact of the program on children and families. Studies have found that unconditional cash transfers have significant impacts on economic outcomes and psychological well-being, as people feel confident in the stream of income they will be receiving and can better plan for advancing in life. Further, parents are more likely to spend monthly cash transfers on essentials like food and utilities than they are with large, annual transfers. Families have understandable difficulties budgeting for their end-of-year lump-sum EITC or CTC benefits because rent is due monthly, and groceries are purchased weekly. Thus, lump-sum annual transfers are more likely to be spent on durable goods and major purchases (Haushofer & Shapiro, 2016).

While work requirements and means-testing can be well-intentioned, and perhaps necessary for certain types of benefits, lawmakers must take care to avoid creating overly complex programs that end up reinforcing rather than tearing down barriers to socioeconomic mobility (Waxman & Hahn, 2021). Instead, the goal of the welfare system should be to efficiently and effectively support the vulnerable while removing disincentives for work and income growth. A child allowance that is predictable, fully refundable, and with higher, slow phase-out levels can best accomplish those priorities.

Priority Three: Effectively Administered

Finally, the Child Tax Credit must be more effectively administered than it is currently. The government should provide predictable, simple payments to families through established channels, such as the IRS. The complex nature of the United States’ welfare programs results in decreased productivity and time loss (Thompson, 1994).

Rather than promoting work and socioeconomic mobility, this reality may make finding work more difficult for low-income individuals, deepening dependence on government support. More research should be conducted in this area to get a better sense of the magnitude of efficiency loss caused by strictly means-tested social welfare programs like those in the United States.

Additionally, the programs tend to miss the people who need the benefits the most. The Temporary Assistance for Needy Families (TANF) program is a federal block grant provided to states to fund their family and child support programs. During the COVID-19 pandemic, just 21 percent of low-income families received TANF benefits in 2020, compared to 68 percent in 1996 (Policy Basics: Temporary Assistance for Needy Families., 2022).

Further, the complex requirements create more administrative burdens for already overstretched government agencies. The federal government loses about $600B to tax fraud and underpayments every year. This “tax gap” will cost the government $7 trillion in lost revenue over the next decade — and it’s mostly the wealthy that can avoid paying their full tax bill. Researchers estimate that the top one percent of earners account for 28 percent of the unpaid taxes in the United States (Treasury, 2021). The IRS needs more staffing and updated technology; they do not need more complex tax and welfare systems that force them to spend inordinate amounts of time auditing those in the lowest income brackets.

A Reasonable Path Forward

Senator Romney’s Family Security Act and the American Rescue plan’s expanded Child Tax Credit have enough common priorities and policies that the plans should be used as the baseline for negotiations moving forward. Conservative priorities, such as minimizing the marriage penalty in the tax code and reducing the impact on the federal deficit, do not destroy hope for a robust child allowance system that supports low- and middle-income families. Legislators should ensure that those impacted by a major change in the tax code, such as modification of the EITC or removal of the head of household status (particularly for single parents), do not see their benefits or support drop dramatically. If Congress does not take care, these decisions can result in instability for millions of households.

If work requirements must be introduced for political feasibility, the requirements should be simple and easy to navigate. A proposal that may work to appease conservatives would be a simple proof of work with a W-2 form or other documentation within a recent period, perhaps two years. Those out of work for reasons outside of their control, actively searching for a job, or focused on raising their children will still receive the full benefit. Parents will have the peace of mind that a base level of income will be there to help provide the essentials for their children.

CONCLUSION

In a time of global economic uncertainty, the time is now to strengthen our support for parents, especially those of lower- and middle-income. The ultimate aim of a child allowance policy should be twofold: 1) reduce child poverty and 2) encourage Americans to bear and raise children in stable homes. A balanced consideration of liberal and conservative values and policy priorities can engender a solution that accomplishes these goals. Converting the Child Tax Credit into a highly refundable monthly child allowance will reduce child poverty, promote social stability, and generate economic dynamism and growth. America’s children deserve solutions, not legislative bickering and inaction.

REFERENCES

Ananat, E., Glasner, B., Hamilton, C., & Parolin, Z. (2021). Effects of the Expanded Child Tax Credit on Employment Outcomes. Columbia University Center on Poverty and Social Policy.

Baird, S., McKenzie, D., & Özler, B. (2018). The effects of cash transfers on adult labor market outcomes. IZA J Develop Migration, 8, 22. https://doi.org/10.1186/s40176-018-0131-9

Bellafiore, R. (2021). Salt deduction: Who benefits from the state and local deduction? Tax Foundation. Tax Foundation. https://taxfoundation.org/salt-deduction- benefit/

Bennet, M. F., Brown, S., Booker, C. A., Warnock, R., & Wyden, R. (2022, January 26). Senate Democrats Letter to President Biden on the Child Tax Credit. https://s3.documentcloud.org/documents/21186217/senate-democrats-child-tax- credit-letter-to-biden-and-harris.pdf

Browning, M. (1992). Children and Household Economic Behavior. Journal of Economic Literature, 30(3), 1434–1475. http://www.jstor.org/stable/2728065

Campbell, A. L. (2002). Self-Interest, Social Security, and the Distinctive Participation Patterns of Senior Citizens. The American Political Science Review, 96(3), 565– 574.

Canada child benefit (CCB). (2021, May 17). Canada. https://www.canada.ca/en/revenue-agency/services/child-family-benefits/canada- child-benefit-overview/canada-child-benefit-we-calculate-your-ccb.html

Chang, C., & Madrick, J. (2016). Investing in our kids using one simple tool: Cash. In The Century Foundation. https://tcf.org/content/commentary/investing-in-our- kids-using-one-simple-tool-cash/

Claim child benefit. (2014). United Kingdom. https://www.gov.uk/child-benefit Crandall-Hollick, M. L. (2021). The Child Tax Credit: Legislative History.

Congressional Research Service, R45124. https://sgp.fas.org/crs/misc/R45124.pdf

Eliminate or modify head-of-household filing status. (2018). Congressional Budget Office. https://www.cbo.gov/budget–options/54789

Eliminating the head of household filing status would hurt women. (2017). National Women’s Law Center. https://nwlc.org/wp-content/uploads/2017/08/Eliminating- the-Head-of-Household-Filing-Status-Would-Hurt-Women.pdf

Fertility rate, total (births per woman)—United States. (2022). World Bank. https://data.worldbank.org/indicator/SP.DYN.TFRT.IN?locations=US

Floyd, I., Pavetti, L., & Schott, L. (2017). TANF Reaching Few Poor Families. Center on Budget and Policy Priorities.

Fram, A. (2021). Manchin not backing Dems’ $2T bill, potentially dooming it. AP NEWS. https://apnews.com/article/manchin-rejects-biden-spending-bill- democrats-election-e7a0ca4c25c686e91cb21e166c44821b

Garfinkel, I., Sariscsany, L., Ananat, E., Collyer, S., & Wimer, C. (2021). The Costs and Benefits of a Child Allowance. Center on Poverty and Social Policy at Columbia University. https://static1.squarespace.com/static/610831a16c95260dbd68934a/t/6113e84ec4ea72172c221d2c/1628694621357/Child-Allowance-CBA-discussion-paper- CPSP-2021.pdf

Gleckman, H. (2022). Why Congress really is fighting over the refundable Child Tax Credit. Forbes. https://www.forbes.com/sites/howardgleckman/2022/01/28/why- congress-really-is-fighting-over-the-refundable-child-tax-credit/

González, L., & Trommlerová, S. K. (2021). Cash Transfers and Fertility: How the Introduction and Cancellation of a Child Benefit Affected Births and Abortions. Journal of Human Resources, 0220-10725R2. https://doi.org/10.3368/jhr.59.1.0220-10725R2

Hamilton, L., Roll, S., Despard, M., Maag, E., & Chun, Y. (2021). Employment, Financial and Wellbeing Effects of the 2021 Expanded Child Tax Credit: Wave 1 Executive Summary. Social Policy.

Hammond, S. (2021). Measuring the Child Tax Credit’s Economic and Community Impact. Niskanen Center. https://www.niskanencenter.org/report-measuring-the- child-tax-credits-economic-and-communityimpact/.

Haushofer, J., & Shapiro, J. (2016). The short-term impact of unconditional cash transfers to the Poor: Experimental Evidence from Kenya. The Quarterly Journal of Economics, 131(4), 1973–2042. https://doi.org/10.1093/qje/qjw025

Holzer, H. J., Whitmore Schanzenbach, D., Duncan, G. J., & Ludwig, J. (2008). The economic costs of childhood poverty in the United States. Journal of Children and Poverty, 14(1), 41–61. https://doi.org/10.1080/10796120701871280

Hulse, C. (2022). After a day of debate, the voting rights bill is blocked in the Senate. The New York Times. https://www.nytimes.com/2022/01/19/us/politics/senate-voting- rights-filibuster.html

Jabbari, J., Hamilton, L., Roll, S., & Grinstein-Weiss, M. (2021). The new child tax credit does more than just cut poverty. Brookings Institution. https://www.brookings.edu/blog/up–front/2021/09/24/the-new-child-tax-credit- does-more-than-just-cut-poverty/

Laroque, G., & Salanié, B. (2005). Does Fertility Respond to Financial Incentives? (CEPR Discussion Paper No. 5007). C.E.P.R. Discussion Papers. https://econpapers.repec.org/paper/cprceprdp/5007.htm

Lino, M. (2015). Expenditures on children by families. Dept. of Agriculture. https://fns- prod.azureedge.us/sites/default/files/resource-files/crc2015-march2017.pdf

Matthews, D. (2016, May 23). Sweden pays parents for having kids—And it reaps huge benefits. Why doesn’t the US? Vox. https://www.vox.com/2016/5/23/11440638/child-benefit-child-allowance

Morgan, S. P. (2003). Is low fertility a twenty-first-century demographic crisis? Demography, 40(4), 589–603. https://doi.org/10.1353/dem.2003.0037 Nikulina, V., Widom, C. S., & Czaja, S. (2011). The role of childhood neglect and childhood poverty in predicting mental health, academic achievement and crime in adulthood. American Journal of Community Psychology, 48(3–4), 309–321. https://doi.org/10.1007/s10464-010-9385-y

Parolin, Z., Sophie, C., & Curran, M. A. (2022). Absence of Monthly Child Tax Credit Leads to 3.7 Million More Children in Poverty in January 2022. Poverty and Social Policy Brief, 6(2). www.povertycenter.columbia.edu/publication/monthly- poverty-january-2022

Philbrick, I. P. (2022). Why isn’t Biden’s expanded Child tax credit more popular? The New York Times. https://www.nytimes.com/2022/01/05/upshot/biden-child-tax- credit.html

Policy basics: Temporary assistance for needy families. (2022). Center on Budget and Policy Priorities. https://www.cbpp.org/research/family-income- support/temporary-assistance-for-needy-families

Pulliam, C., & Reeves, R. V. (2022). The Salt Tax Deduction is a handout to the rich. Brookings Institution. https://www.brookings.edu/blog/up–front/2020/09/04/the- salt-tax-deduction-is-a-handout-to-the-rich-it-should-be-eliminated-not-expanded/

Raphael, D. (2011). Poverty in childhood and adverse health outcomes in adulthood. Maturitas, 69(1), 22–26. https://doi.org/10.1016/j.maturitas.2011.02.011 Rector, R., & Hall, J. B. (2021). Government supports would grow to $76,400 per poor family. The Heritage Foundation. https://www.heritage.org/welfare/commentary/government-supports-would-grow- 76400-poor-family

Romboy, D. (2021). How Mitt Romney proposes to encourage Americans to create families, have children. Deseret News. https://www.deseret.com/utah/2021/3/23/22346532/how-mitt-romney-proposes- encourage-americans-create-family-have-chidlren-ross-douthat

Romney, S. M. (2021). The Family Security Act. https://cdn.vox- cdn.com/uploads/chorus_asset/file/22279576/family_security_act_one_pager_app endix.pdf

Rostad, W. L., Klevens, J., Ports, K. A., & Ford, D. C. (2020). Impact of the United States federal child tax credit on childhood injuries and behavior problems. Children and Youth Services Review, 109, 104718. https://doi.org/10.1016/j.childyouth.2019.104718

Roth, P. (2021). Reducing the marriage penalty for low-income families. American Enterprise Institute. https://www.aei.org/poverty-studies/reducing-the-marriage- tax-penalty-for-low-income-families/

Rubio, Florida, U. S. S., & Rubio, M. (2021). Lee Push Pro-Work child tax credit amendment. https://www.rubio.senate.gov/public/index.cfm/2021/8/rubio-lee- push-pro-work-child-tax-credit-amendment

Sarlo, C. (2013). The Cost of Raising Children (August 22, 2013. Fraser Institute. https://ssrn.com/abstract=2318106

Sarlo, C. A. (2021). Does the Canada Child Benefit actually reduce child poverty? https://fraserinstitute.org/sites/default/files/does-the-canada-child-benefit- actually-reduce-child-poverty.pdf

Schnell, M. (2021). Majority in new poll says expanded Child Tax Credit should not be permanent. The Hill. https://thehill.com/policy/finance/564063-majority-in-new- poll-says-expanded-child-tax-credit-should-not-be-permanent/

Shabad, R., Haake, G., V, T., F., & Tsirkin, J. (2021). Manchin privately raised concerns that parents would use child tax credit checks on drugs. NBCNews.Com.

https://www.nbcnews.com/politics/congress/manchin-privately-raised-concerns- parents-would-use-child-tax-credit-n1286321

Skiera, A. (2022, October). Personal independence behind declining birth rates. Harris Poll. https://theharrispoll.com/briefs/birth-rates/

Sterling, J., Jost, J. T., & Hardin, C. D. (2019). Liberal and conservative representations of the good society: A (social) Structural Topic Modeling Approach. SAGE Open, 9(2), 215824401984621. https://doi.org/10.1177/2158244019846211T20-0182. (2020). Tax Policy Center. https://www.taxpolicycenter.org/model- estimates/health-and-economic-recovery-omnibus-emergency-solutions-heroes- act-may-2020/t20-7

Tax compliance: Trends of IRS audit rates and results for individual taxpayers by income. (2022). U.S. Government Accountability Office. https://www.gao.gov/products/gao-22-104960

Thompson, L. H. (1994). The Advantages and Disadvantages of Different Social Welfare Strategies. Social Security Bulletin, 57, Ser. 3. https://www.ssa.gov/policy/docs/ssb/v57n3/v57n3p3.pdf

Treasury, U. S. D. (2021). The case for a robust attack on the Tax Gap. https://home.treasury.gov/news/featured-stories/the-case-for-a-robust-attack-on- the-tax-gap

Troller-Renfree, S. V., Costanzo, M. A., Duncan, G. J., Magnuson, K., Gennetian, L. A., Yoshikawa, H., Halpern-Meekin, S., Fox, N. A., & Noble, K. G. (2022). The impact of a poverty reduction intervention on infant brain activity. Proceedings of the National Academy of Sciences, 119(5). https://doi.org/10.1073/pnas.2115649119

Waxman, E., & Hahn, H. (2021). Work requirements sound good, but the evidence just doesn’t support them. Urban Institute. https://www.urban.org/urban-wire/work- requirements-sound-good-evidence-just-doesnt-support-them

What is the earned Income Tax Credit (EITC)? (2022). Tax Foundation. https://taxfoundation.org/tax-basics/earned-income-tax-credit-eitc/