David Eccles School of Business

4 The Intersection of Entrepreneurship and Latinx Critical Theory: An Analysis of Revenue Performance and Loan Approvals of Construction Contractors in Utah

Luis Ramirez

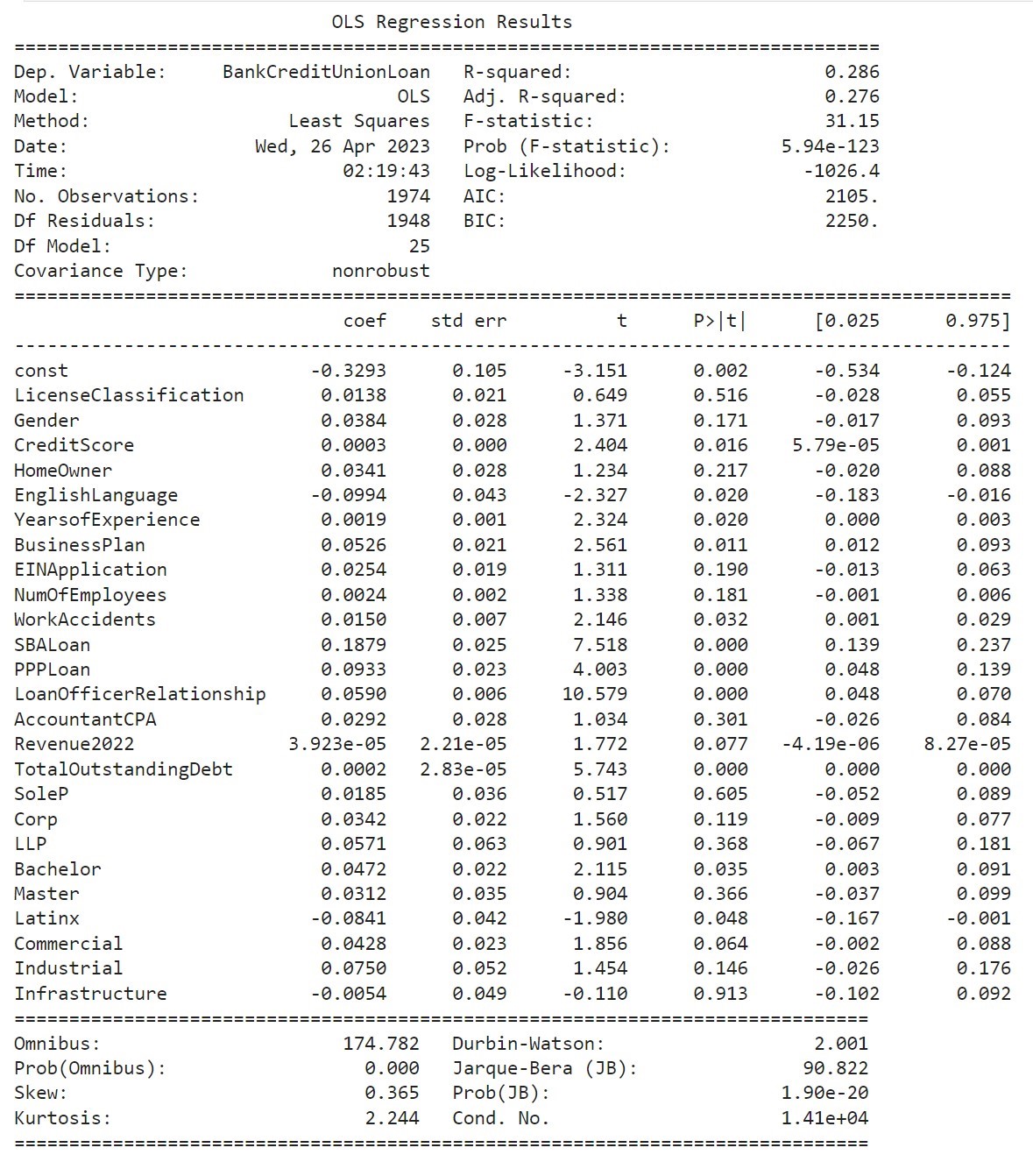

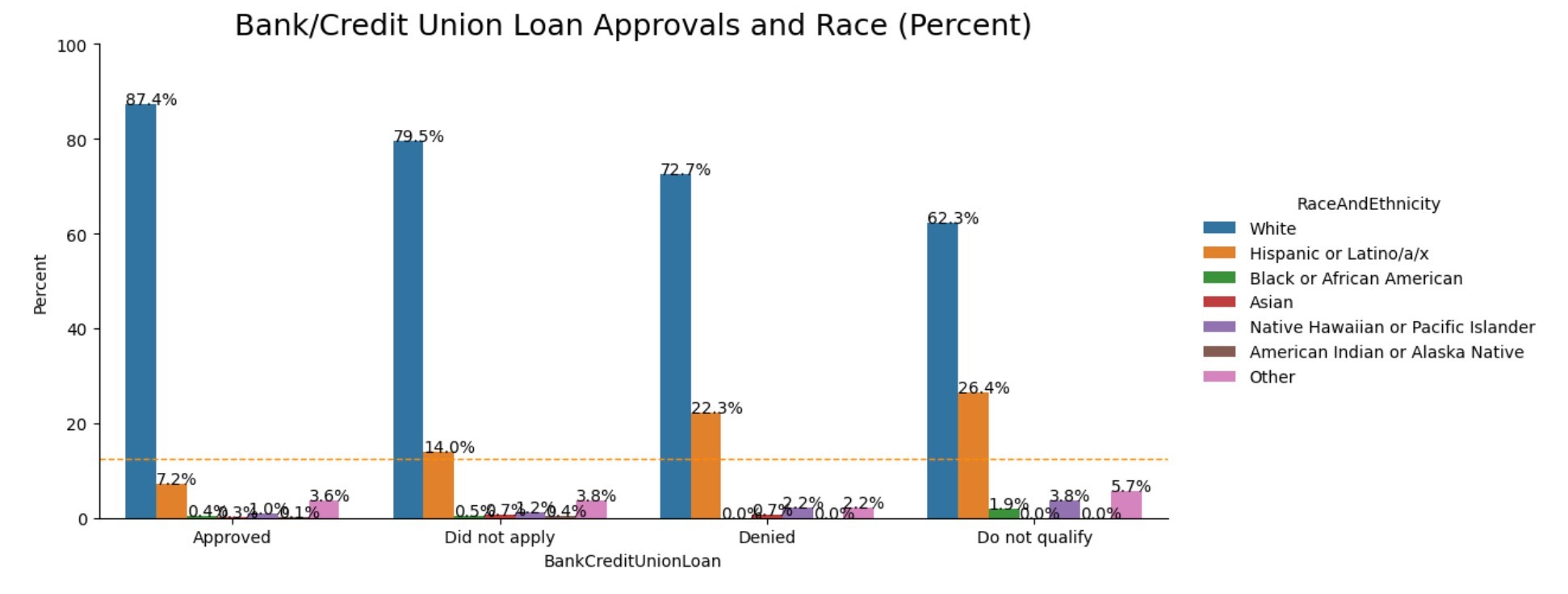

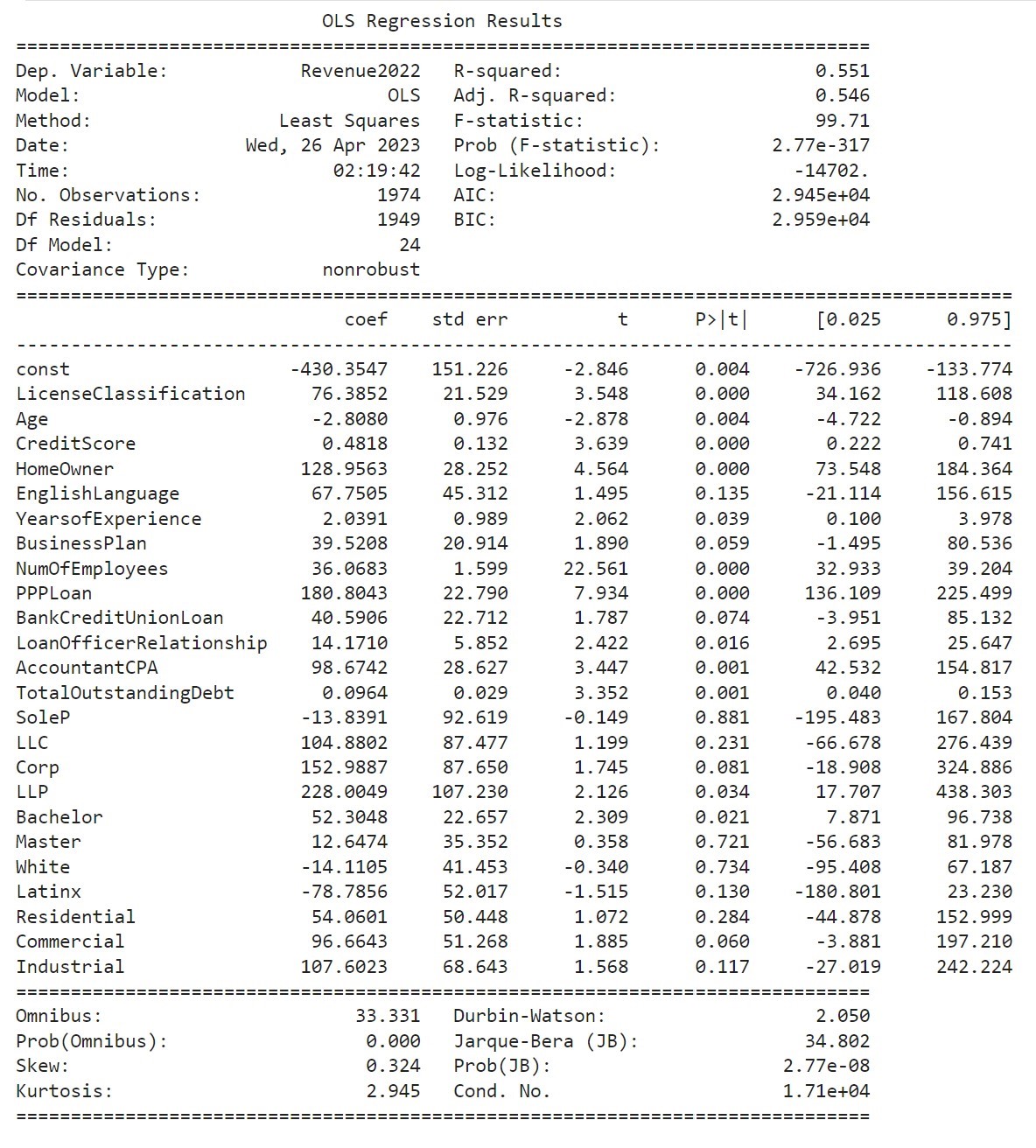

Disproportionate outcomes exist in entrepreneurship based on the identity of the founders. While the Hispanic/Latinx population accounts for 19% of the United States population, Hispanic/Latinx owned businesses account for only 5.8% of all businesses. We are especially interested in understanding how a Latinx identity impacts entrepreneurial outcomes in the low-barrier industry of construction. Since many studies explore the obstacles and barriers in education for Latinx students, this paper explores the challenges in accessing capital financing in the form of credit. This study collects the contact information of over 27,000+ licensed construction contractors from the Utah Department of Occupational and Professional Licensing to distribute a IRB-approved 28 question Qualtrics survey. The survey collects firm data and owner demographic data. The survey data is analyzed with Python programming language to run descriptive statistics and regression analysis on revenue performance and bank loan approvals. Our survey received a survey response rate of 7.2 percent (n=1,974). The results from the survey showed that there is a disparity between the percent of Latinx contractors in Utah (12.5 percent) and the loan approval rates of Latinx for business loans from banks and credit unions (7.2 percent) (figure 1.). The regression (figure 2.) on annual revenue performance (r-squared = 0.55) found that contractors generated $40k more if they had a business loan from a bank (p-value = 0.07), $180k more if they had a PPP loan (p-value=0.00), $76k more if they were a general contractor instead of subcontractor (p-value=0.00), $2k more per year of experience (p-value=0.039), $39k more if they had a business plan (p-value=0.059), $36k more per employee hired (p-value=0.00), $98k more if their accountant is CPA (certified public accountant) certified (p-value=0.001), $152k if they have a C-Corp instead of L.L.C. or sole proprietorship (p-value=0.081), and $52k more if they have a bachelors degree (p-value=0.021). The regression (figure 3.) on loan approval rates (r-squared=0.28) found that contractors loan approval rates increased by 0.19 percent per year of experience (p-value=0.02), 5.2 percent if they have a business plan (p-value=0.01), 18.7 percent if they previously qualified for a SBA loan (p-value=0.00), 4.7 percent if they have a bachelor’s degree (p-value=0.03), and 4.2 percent if they focus on commercial instead of residential construction (p-value=0.06). The regression on loan approval rates also found that the bias of the loan officer (p-value=0.00) can impact loan approval rates by up to 29.5 percent, and English as a first language (p-value=0.02) decrease loan approval by 9.9 percent. The results from the findings prove that banks and credit unions must mitigate the bias of loan officers and create equitable credit assessments for Latinx entrepreneurs on construction companies. Furthermore, construction contractors can increase their annual revenue performance and loan approval rates by becoming general contractors, hiring more employees, upgrading to a C-Corp if they have an L.L.C., having a CPA-certified accountant, borrowing more money, and completing a bachelor’s degree.

Figure 1: Bank and Credit Union Loan Approvals by Race (Percent)

Figure 2: Regression on Revenue

Figure 3: Regression on Bank Loan Approval