15 Chapter 15: Policies for Natural Resources Sustainability

I aspire to be an environmental policy “wonk.” Likely, you don’t. Yet even if you don’t watch the PBS News Hour or Global Public Square or read the Washington Post or the New York Times—some of the best ways to stay informed about what’s going in the United States and the world—you can’t have completely missed the debates over climate change or fracking that have made environmental policy front page news. But there are a lot, an awful lot, of important developments and policies being made that don’t register on the radar screen of even in-depth reporting, no less the popular cable TV news and viral Internet stories, which are perhaps better thought of as “news-ertainment.” Before we launch into insider topics, let’s start at the beginning. What is policy and how is it made?

The Policy Process

Policy is a decision made by an institution that has authority over employees, products, citizens, or other entities. Companies and corporations make policies as do colleges and universities. Your instructor makes policies over how your grade will be determined and your college makes policies governing what courses you need to pass to earn a specific degree. The primary purpose of governments is to make policies, some of which can be described as laws. The purpose of the legislative branch, the House of Representatives and Senate at the national level and similar bodies at the state level, is to write statutes, but it doesn’t stop there.

The judicial branch decides cases that serve as precedent in subsequent cases and in so doing builds the common law. The executive branch also has an important role to play in making policy as well as the lead role in implementing it. The U.S. Environmental Protection Agency (EPA), for example, is charged with implementing the Clean Air Act, the Clean Water Act, and a dozen other environmental statutes that both houses of Congress have passed and the president has signed into law. Often, the statutes passed by Congress omit many of the important details for implementation, leaving to executive branch agencies like the EPA, the U.S. Department of Agriculture, or the Department of Interior the task of rulemaking, of writing the actual regulations that the country must follow. State and local governments operate similarly, creating a complex web of environmental policy across three branches of government and at least three geographic levels—a system of shared responsibility referred to as federalism.

Do you remember the lesson from social studies class on how a bill becomes a law? Using an important example, bills to regulate greenhouse gas emissions, let’s walk through this process. In 2007 Senators Lieberman and Warner, or more accurately the young legal staff that work for them, prepared the America’s Climate Security Act of 2007. Initial projections by party leaders (it’s the whip’s job to keep track of straw polling on upcoming bills) indicated that a slight majority in both the House and the Senate would support it, especially Democrats who held a majority in both houses at the time and therefore controlled which bills come to the floor for debate and vote. Then-President Bush, a Republican, however, indicated that he would veto the bill, and it takes a two-thirds majority in both houses to override a presidential veto. Seeing this obstacle as insurmountable, Democratic leaders decided to table the bill—lay it aside for later with the hopes that the Democratic candidate, Barack Obama (who had indicated his support for the legislation), would win the 2008 election over Republican candidate John McCain.

In 2009, with President Obama in office and a Democratic majority in both houses, the issue came up again. The Waxman-Markey American Clean Energy and Security Act of 2009 came to the floor of the House in June 2009, passing by a narrow 219–212 vote. The similar Clean Energy Jobs and American Power Act, authored by Democratic Senators Kerry and Boxer, was then prepared for consideration by the Senate. But the Senate takes its sweet time. A minority of 41 of 100 Senators can block a bill from coming up for vote by engaging in a filibuster (endless debate) and it takes 60 votes to enact cloture ending debate and forcing a vote. The remainder of 2009 was taken up with Senate debate over the Affordable Care Act as the Obama Administration and Democratic leaders in the Senate worked to gain 60 votes in order to override a filibuster threatened by Republican Senators. The election of Republican Scott Brown of Massachusetts to take over the Senate seat vacated by Democrat Ted Kenney’s death strengthened their hand.

When the historic Affordable Care Act was passed in early 2010 by a legislative maneuver that made an end-run around the Senate filibuster, the Kerry-Boxer cap-and-trade bill was next in line and faced a very similar legislative fight. With the mid-term elections coming up in November 2010, and with very little Republican support, the Democrats decided to table the bill again, likely on the calculation that a second historic legislative battle would cost them even more votes in November. So the bill went into limbo, and was set aside when the Republicans took a majority in the House in the 2010 mid-term elections.

Control of greenhouse gases, however, has a second legal angle residing in the judicial and executive branches. In 2007, in Massachusetts v. EPA, the U.S. Supreme Court decided that the EPA administrator must determine whether greenhouse gases pose a danger to public health, and if they do, regulate emissions. On April 17, 2009, EPA issued a preliminary statement finding that they do after considering 380,000 comments received from the public in the notice and comment informal rulemaking process. After considering these comments, the EPA issued its final finding on December 7, 2009: greenhouse gas emissions pose a threat to human health and welfare. This finding requires the EPA to regulate greenhouse gases under the Clean Air Act.

The next step is for EPA to write the regulations following the Administrative Procedure Act. Through the rulemaking process, the Obama Administration in June 2014 issued notice for a proposed rule called the Clean Power Plan targeted at reducing greenhouse gas emissions from the generation of electricity. After receiving thousands of comments and modifying the rule in response to them, the final rule was issued in August 2015. It was challenged in the courts by a collection of 14 states, however, which placed a stay (a delay in implementation) on it until certain legal issues were worked through. The Trump Administration then issued an executive order on March 28, 2017 reviewing the Clean Power Plan. On August 21, 2018, the EPA provided notice of a proposed rule called Affordable Clean Energy that de-emphasized control of greenhouse gas emissions. The final rule was issued on June 19, 2019.

Meanwhile, ten U.S. states (CA, CN, DE, MA, MD, ME, NH, NY, RI, VT) went ahead with their own carbon emission control policies, generally following some form of cap-and-trade.

In 2022, with Democrats holding the White House and very narrow majorities in both houses of Congress, legislation to combat climate change came up again, initially as part of a huge collection of investments termed “Build Back Better.” But after several rounds of negotiations, a majority could not be found for this legislation. Instead a much smaller, but still substantial, partisan compromise was found in the form of the Inflation Reduction Act. While the name of this bill is pure political spin, it provides about $400 billion in tax credits for clean energy investments, from huge wind and solar farms to electric vehicles to heat pumps. It’s passage onto law reflects that, while a consensus could not be reached on penalizing carbon emissions, a majority do support subsidizing with taxpayer dollars the transition to sustainable energy systems. Rather than internalizing the cost of greenhouse gas emissions—the social cost of carbon—this approach makes low-carbon energy cheaper and thus more economically competitive against fossil fuel-based energy. Sticks-no; carrots-yes.

What this particularly fascinating and relevant example shows is that the lesson in how a bill becomes a law you learned in social studies class is like learning that, in chess, a bishop moves diagonally and a rook moves straight. When actual policy decisions come along, however, it becomes a matter of actually playing chess—to win—in a power struggle among groups whose interests and philosophies may be in conflict.

In the regulation of greenhouse gas emissions example, some interest groups are naturally in opposition; the fossil fuel and automobile industries come first to mind but also many average citizens who are concerned about increasing prices for electricity and gasoline. How do these groups stack up against the coalition in favor of the legislation: people who are concerned about climate change impacts, the renewable and nuclear energy industries, the property insurance industry who doesn’t want to keep paying for the natural disasters climate change brings forth, and so on. And there are a lot of tactics at play, especially the efforts by the former groups to cast doubt on the science of climate change and to argue that controlling greenhouse gas emissions will ruin the economy. Like all policy, environmental policy is politics. As in a football or basketball game, it’s a power struggle structured by rules. The heart of the political process is attempts to gain the leverage to structure rules that give your interests a competitive advantage. Sometimes one team wins and the other team loses, though neither victories nor defeats are ever permanent because the season never ends.

Like many, perhaps most, Americans, I find much to critique in this policy-making process. The two dominant political parties play too much against one another and too little for the American people, no less the environment. Money, through campaign contributions that fund media propaganda in ever-lengthening, perhaps even permanent election seasons, has too much influence on who gets elected and the policies they favor once in office. Special interest groups—banks, insurance companies, oil companies, retired people—who can afford the best lobbyists have undue influence and even seem sometimes to be writing the laws and regulations for their own benefit. The media, often owned by these same interests, consistently misses the bigger picture and instead focuses on emotion-grabbing conflicts, vexing improprieties that scrape against our sense of moral and ethical behavior, details of celebrity’s personal lives, and sentimental human interest stories. That gets ratings and ratings determine how much advertisers have to pay, which determines whether the news show makes a profit. Meanwhile, the important things that are really going on in the world sometimes receive little attention—unless you consciously look for it beyond the bounds of cable TV news, talk radio, and Internet noise. There is indeed a lot to complain about U.S. democracy, perhaps more than there has been in a century.

In my limited interactions with the political system, however, I’ve found that it is less corrupt than the cynical public believes and conspiracy theories hold little water. Rather what we have is a battle of interests and a struggle of interpretations founded in beliefs and cultural identities, with unequal capacities to advance these interests and interpretations. Participate in this flawed system and you’ll win some battles and lose the rest. Opt out and you’ll lose them all by default.

Principles of Sustainable Policies

The often-stated three normative goals for policy making are efficiency, equity, and sustainability. Neoclassical economics, which we studied in Chapter 6, focuses on efficiency, on maximizing net benefits and cost-effectiveness. As we saw in Chapter 10, political ecology, with its emphasis on social and environmental justice, focuses on equity—fair, if not necessarily equal, outcomes, equal opportunity, and a fair application of the law and rules of the game. Let’s review, especially from Chapter 7 on ecological economics, what sustainability requires. Natural capital must be preserved, and perhaps even restored, so that ecosystem services can continue to benefit people and species can be saved from extinction. This means fewer withdrawals from natural capital in the form of resource extractions and waste emissions and greater investments in ecological restoration and resource use efficiencies.

From these three criteria of policy evaluation we can derive some secondary principles. One is polluter pays. This is a way of preventing the true social and environmental costs of production from being externalized—of making someone else pay for it in the form of degraded ecosystems, destabilized climate and, as was the focus of the popular movie Avatar, undermined indigenous cultures. This is a central principle in pursuing a policy for greenhouse gas emissions, for example. The flip side is provider gets. Ecosystem service provision should be compensated so that it is encouraged.

The precautionary principle states that, when there is uncertainty over the outcome, the policy that minimizes the consequences of the worst case scenario should be adopted. This principle has played a prominent role in limiting nuclear power development and is often raised against development of new chemicals, nanotechnologies, and genetically modified organisms.

Other principles relate to the decision-making process. Subsidiarity calls for policies to be made at as local a level as possible. Local control allows managers to respond to ecological uniqueness and emerging situations rather than be held to rules made thousands of miles away by bureaucrats who know little of local circumstances. Local control can also foster inclusivity and public participation. People are much more likely to follow and consider legitimate rules they helped make or that were developed by their neighbors, rather than distant bureaucrats, whether these are governmental or corporate.

With these means of policy evaluation in hand, it’s time to examine some specific policies that would foster natural resources sustainability. From the long list of possibilities, we’ll focus here on three that are particularly relevant: (1) putting a price on carbon, (2) incentives for sustainable energy, and (3) the Waters of the United States rule governing wetlands.

Putting a Price on Carbon

Whether a substance constitutes pollution is dependent on its context and concentration. Regulations are the dominant form of environ-mental policy when dealing with toxic pollutants like dioxin, DDT, mercury, or lead. Sulfur is a naturally occurring and fairly common element essential to life but it causes respiratory problems and acid rain at high atmospheric concentrations. Carbon dioxide is similarly an essential part of the atmosphere that fuels photosynthesis and helps maintain Earth’s temperature but it becomes the most important component of climate change when concentrations climb.

For pollutants like sulfur and carbon dioxide that are only harmful in excess, and where complete elimination is extremely expensive or not called for on environmental grounds, economic incentives have substantial merit as a flexible form of environmental regulation. As we reviewed in Chapter 6, environmental economists have made a strong argument that emission fees and tradable pollution permits can be more cost-effective in attaining a pollution control goal than can regulations that have dominated environmental policy for decades. These policy mechanisms can achieve a specific politically determined pollution control or ecosystem service provision goal at less cost than other forms of regulation.

Reviewing from Chapter 6, it is nearly always the case that firms in an industry or group of industries that emit a particular pollutant have different marginal abatement costs. Greenhouse gas emissions, for example, come from several sectors of the economy, including electrical power plants, vehicles, and the landscape. Reducing emissions will have different costs in each situation by, say, closing down a coal-fired power plant in favor of wind or solar, switching to a plug-in hybrid car, or planting trees on a cattle pasture.

Emission fees or taxes can achieve equimarginality and thus cost-effectiveness in a straight-forward way. If each firm has to pay a set fee of, say, $25 for each ton of carbon emissions, each will abate pollution where marginal costs are less than $25/ton and pay fees for more expensive reductions.

Moreover, both tradable permits and emission fees give firms an incentive to reduce more pollution than regulations require and to develop technological or institutional means to control emissions at less cost because, by doing so, they can sell permits or avoid buying permits or paying fees.

For these reasons, emission fees and tradable pollution permits have been promoted by environmental economists. These policy mechanisms are also winning adherents within an environmental community that is increasingly coming to the realization that environmental improvements must be made by changing private sector behavior within a competitive capitalist framework. We cannot regulate our way to sustainability. What we will see, however, is that in practice it gets one whole heck of a lot more complex than even this subtle argument would suggest. Nevertheless, it is worth working through the complexities because market-based policy mechanisms such as pollution fees and tradable permits are a critical and increasingly important component of natural resources sustainability.

The U.S. Experience with Cap-and-Trade

Let’s first examine Title IV of the 1990 Clean Air Act amendments governing emissions of sulfur dioxide from coal-fired power plants. The statute set a cap on total sulfur dioxide emissions from coal-fired power plants, distributed initial allowances at a rate of 2.5 pounds per million btu (1.2 pounds after 2000 in Phase II), and allows firms to trade and to bank these allowances. The allowance trading zone is the 48 contiguous states. Phase I (1995–1999) applied to the dirtiest 261 electric power-generating units and Phase II (2000–2010) applied to most fossil fuel units of 25 megawatts or greater.

Did this first major experiment with cap-and-trade work? There has been 100 percent compliance reducing emissions from 8.7 to 4.4 million tons. In fact, affected facilities over-complied in Phase I in order to bank 11 million tons of allowances for use in Phase II. Costs of abatement fell from $2 billion to $1 billion with benefits ten times higher. Similarly, emissions have been further reduced by 1.4 million tons in Phase II, leaving only 3.0 millions tons, a 66 percent reduction overall.

The reductions in sulfur dioxide emissions and abatement costs came largely from utilities switching from high-sulfur to low-sulfur coal, especially from Wyoming. Within utilities, responsibility for buying and selling allowances has shifted from engineers to financial officers responsible for fuel purchases. Initial transaction costs of 30–40 percent of the value of allowances fell to about 1 percent as participation in the program became embraced and routine. Title IV of the Clean Air Act amendments thus serves as the best model of successful real-world application of tradable pollution permits (i.e., cap-and-trade). More recent shifts from coal to other sources of electricity have reduced sulfur emissions even further.

Later attempts to utilize the cap-and-trade approach have not been as successful, however, and it’s important to see why. The Clean Water Act distinguishes between point-source pollution, pipes and other outflows that are directly regulated under the National Pollutant Discharge Elimination System, and nonpoint-source pollution, which is not, but is subject to Total Maximum Daily Load requirements that are focused on ambient water quality in watersheds rather than on discrete emitters.

Since the 1970s, the Clean Water Act, largely through subsidies to construct wastewater treatment facilities, has done a very good job of controlling point sources but not nonpoint sources. For this reason, it is widely believed that nonpoint sources of nutrients, mostly from agriculture, have lower marginal abatement costs than do point sources, mostly from industry and cities. These circumstances have led to the notion that nutrient trading, especially with point sources as allowance buyers and nonpoint sources as allowance sellers, has the potential to achieve positive economic and environmental results such as those achieved with sulfur. Eighteen states have passed legislation allowing the formation of water pollution trading districts for nitrogen and phosphorus and 37 trading districts were formed. As of 2007, however, only 8 districts had conducted any trading, and the total number of trades in the U.S. was a paltry 13. Moreover, only one of these trades involved a nonpoint source. Trades that have occurred are approved by U.S. EPA on a case-by-case basis; no open-market trading has occurred. Why has water quality trading failed where sulfur trading succeeded? We can identify six reasons.

- Equity. Regulated point-source emitters such as sewage treatment plants see as unfair a system where non-point emitters such as farms are not regulated.

- Unregulated nonpoint sources deliver the vast majority of nutrient pollution. How can allowances purchased by point sources do more than scratch the surface of nonpoint runoff?

- Immeasurability. While point-source emissions flowing out a pipe can be easily measured, nonpoint runoff of nutrients from a specific area of land is very difficult to accurately measure. It is dependent on a multitude of factors such as weather, soil type, the location of drainage tiles, the juxtaposition of cropped fields, vegetative filter strips, surface water channels, and groundwater recharge zones. Because of this uncertainty, trading ratios of 2:1, 3:1, or higher were introduced to make sure that a trade does not result in an increase in ambient nutrient concentrations. But with a ratio of 3:1, marginal costs of nonpoint reductions must be less than one-third as high as point source reductions to facilitate a win-win trade, even without considering transaction costs.

- Additions from a baseline. Land use changes that are used to create a nutrient reduction credit may have been undertaken anyway. For example, a farmer may plant soybeans instead of corn and sell a nutrient credit but (s)he would have planted soybeans anyway. So there is a problem of baseline nutrient runoff to which must be applied the principle of additionality—what additional nutrient reductions can be attributed specifically to the land management changes associated with the allowance sold?

- Transaction costs are extremely high because EPA must approve each trade and because farmers and other nonpoint emitters do not normally participate in pollution trading.

- Geography. While the location of sulfur emissions does matter at a regional scale, the specific location of nutrient runoff or emissions is absolutely critical. Trading nutrient pollution reductions in one watershed for increases in another is unsound since the ecological effects of the nutrients are specific to the location in which they occur. For this reason, the spatial extent of pollution trading must be defined by relatively small watersheds that generally do not contain a critical mass of potential traders.

Cap-and-Trade or a Carbon Tax?

Either cap-and-trade or a carbon tax would force us to buy our carbon footprint while driving greenhouse gas emission abatement toward equimarginality and thus cost-effectiveness. The next question is which is better? The tradability in permit systems facilitates relationships both among polluting firms and between them and sequestration projects. The cap in a cap-and-trade system can require emissions to be reduced at a predetermined rate. For example, the bills that have been proposed in Congress have caps that decline linearly from levels in the year the law takes effect to a 75–80 percent reduction in 2050. This can lead, however, to volatile prices for permits on the carbon market.

The alternative to a decreasing emissions cap is an escalating carbon tax that starts at, say, $20/ton and steadily climbs to perhaps $100/ton in 2050. While this makes the price of carbon predictable, it is difficult to know how rapidly emissions would be reduced as a result. It would also fail to build a direct transactional relationship between carbon emitters and sequestration and storage projects, for better or worse. In fact, a separate carbon credit program, perhaps organized by the U.S. Department of Agriculture, would be required.

When I weigh these pros and cons in the cap-and-trade vs. carbon tax/fee debate, I come out with a practical solution: either is far preferable to a situation where greenhouse gas emissions are unregulated and emitted for free. A carbon tax does have a strong element in its favor, though. A cap-and-trade system anchors emissions while making costs volatile. A tax anchors costs, but it allows emissions to vary. The latter may be preferable because implementation of the long-term, capital-intensive projects that would effectively reduce carbon emissions require certainty of costs. That way companies and investors can place many millions of dollars on the line for a solar or wind farm instead of a coal or gas-fired power plant knowing that the planned carbon taxes—high for coal, moderate for gas, zero for solar or wind—make solar or wind the best investment. With cap-and-trade there’s too much uncertainty over permit prices to make this kind of calculation with any confidence. Moreover, carbon taxes can be redistributed to all Americans as a dividend (how about on Black Friday?), potentially making the policy a popular one on election day.

Incentives for Sustainable Energy

As we saw in Chapter 14, sustainable energy is on the march in the U.S. and elsewhere. Even in the absence of strict limits on greenhouse gas emissions, policies have helped this revolution along. Here we will focus on three primary policies: renewable portfolio standards, tax credits, and net metering.

Renewable portfolio standards. RPS originated in Iowa in 1983 as a way to promote ethanol from corn. By 2000, 11 states had passed RPS, and by 2022, 31 states had passed regulations that set goals for a certain percentage of energy produced or consumed in that state to come from designated renewable sources by a target year. Statistically, states with RPS have greater production of wind power, all other things being equal, than states without, so RPS standards can be viewed on the whole as fostering natural resources sustainability. But we must ask, what is renewable energy?

In Chapter 7 on Ecological Economics, we defined resources based on their renewability ratio: the rate of creation divided by the rate of consumption. These are low for fossil fuels, making them fall into the nonrenewable category, and high for solar energy and its direct derivatives like wind and hydroelectricity, placing them in the renewable category. Two other important energy sources, however, are more problematic. Nuclear energy relies on uranium or other radioactive elements like thorium that have large supplies relative to the very slow rate at which they are used, and perhaps consumed, in nuclear fission reactors. Does that make nuclear energy renewable? Biofuels rely on photosynthesis and compete for it with the food supply and habitat for biodiversity. So is it renewable? By standard definitions founded in the renewability ratio, it must be, but is it sustainable?

Let’s go back to the analysis presented in Chapter 13 where we found that fossil fuels are actually quite abundant on Earth with reserve-to-production ratios that climb to truly high levels if we consider the vast volumes of lower quality fossil fuels like oil sands, gas and oil shale, and coal. We concluded that it is peak emissions of carbon rather than peak oil that is the salient issue.

If running out of nonrenewable resources like fossil fuels is not the issue, then why define energy sources on their renewability rather than their sustainability with respect to carbon emissions and other sustainability indicators? This makes biofuels renewable but perhaps not sustainable, given their high footprints for water, nutrients, even carbon, and their effects on land use and therefore food supplies and biodiversity. It leaves nuclear energy in a very ambiguous position and hydroelectricity less clearly sustainable than it is renewable. Wind and solar energy come out as clearly both renewable, due to their reliance on never-ending streams of radiation from the sun, and sustainable, due to their very low footprints, including for water and nutrients as well as carbon. This analysis makes questionable the crediting of biofuels toward RPS or the subsidization of biofuel production.

Also, energy never consumed is even more sustainable than wind and solar power, so megawatts and other indicators of energy avoidance should count. I’d still support RPS for the push they’ve given to wind power, and likely are also starting to do so for solar, but also argue that it is time to change the concept from renewable to sustainable energy standards.

Tax Credits. Originating in the Energy Policy Act of 1992, the Production Tax Credit provides producers of wind, solar, and bioenergy with a substantial reduction in taxes for investing in new production capacity. Congress has a history of allowing the Production Tax Credit to expire, such as in 1999, 2001, and 2003 and with last-minute extensions in other years. In modified form, it was extended by the Inflation Reduction Act in 2022. When the history of U.S. wind power installation is compared with the history of the Production Tax Credit, it is clear that companies are holding back in years when it is not in effect, hoping it will be renewed, and then going forward with huge investments when it does come back into effect.

The parallel Solar Investment Tax Credit started in 2006 and was renewed in 2015, providing a 30 percent tax credit on new solar installations, both for utilities and roof-top solar projects. It was also extended by the Inflation Reduction Act. These tax credits have had a huge impact in jump-starting wind and solar energy in the U.S. by improving the rate of return on these energy investments to the point where they make good financial sense. They are thus central to the sustainable energy revolution the U.S. has been enjoying. This can be viewed as justified on the grounds that wind and solar do not produce the negative environmental externalities of fossil fuel-based energy.

Another argument is based on the idea of infant industries. New technologies are never as cost-effective as older more established ones that have enjoyed decades of tweaking and optimization under competitive capitalist conditions. Yet, if given the opportunity to gain some momentum, new technologies like wind and solar power can reduce costs and eventually become cost-competitive with older fossil fuel-based technologies. The same is true of electric cars, which receive similar tax credits of up to $7,500. In several years, electric vehicles may be cheaper than internal combustion engine vehicles and these subsidies will have done their job of transforming the auto industry.

This jump start for infant industries is exactly what has happened, with the cost of wind and solar falling to the level of coal and gas in the late 2010s. Therefore, the phasing out of these tax credits may not have a disastrous impact on the sustainable energy revolution. Still, if wind and solar lack the environmental impacts of fossil fuels, the polluter pays principle demands that either greenhouse gases are taxed or sustainable energy is subsidized in order to maintain a level playing field in the competition among these technologies and the companies that seek to profit from implementing them.

Net metering. Millions of American homes, including my own, have placed solar panels on their roofs. When I mention this to friends or neighbors, often the next question is “are you off the grid?” My answer is “if I’m off the grid, I can’t use the grid to my advantage.”

Net metering allows producers of solar energy to sell their surplus power production—say on sunny days that aren’t hot enough for air conditioning—back to the grid, turning their meters backward and only paying for the net electricity they consume. As long as they aren’t a net power producer on an annual basis, the electric utility has to credit the solar output they’re supplying to the grid. Remember that solar (and wind) are intermittent. That means that, unless you also invest in a great deal of electricity storage, a solar home still needs electricity from the grid, especially after the sun sinks westward or when the rooftop solar panels are buried in winter snow. It also needs a market for its surpluses. So net metering allows solar producers to utilize all the power they produce to offset electricity purchases by using the grid to their advantage.

Of course, from an electric utility’s standpoint, net metering forces them to buy all the products their competitors are making. This is a difficult business model, so they are pushing back. Moreover, a solar producer who has little or no electricity consumption from the utility isn’t paying for the grid’s overall infrastructure, passing that cost onto the nonsolar customers.

The outcome of this tug-of-war is different in every state, with 33 states offering net metering as of 2022. Net metering rules is an active field for modifying laws and regulations in many states.

Taken together, renewable portfolio standards, the production and solar investment tax credits, and net metering for rooftop solar have countered the lack of restrictions on greenhouse gas emissions to facilitate the sustainable electricity revolution we explored in Chapter 14. Together with the steady decline in costs for wind and the precipitous fall in costs for solar, due to technological advances, all of these policies have helped make wind and solar power financially sound investments. That is the key to inducing people, from homeowners to utility company executives, to build them. So, perhaps it was worth slogging through Chapters 6 though 9 on economics after all! Becoming an environmental policy wonk is partly about understanding how policies affect economic incentives, carrots and sticks, and therefore natural resource sustainability outcomes.

The Waters of the U.S. (WOTUS) Rule Governing Wetlands

As we saw in Chapter 7 on Ecological Economics, wetlands are the landscape’s best ecosystem service factories, producing biodiversity, carbon storage, nutrient filtration, and water storage to mitigate floods. These services have quite large economic values, though often they do not accrue to the landowner, in what we described in Chapter 9 as a tragedy of ecosystem services. Because of this mismatch in incentives to landowners, some kind of policy is needed to protect wetlands from being converted into shopping malls or, much more commonly, crop fields. Otherwise, the public stands to lose the ecosystem services wetlands are providing for them.

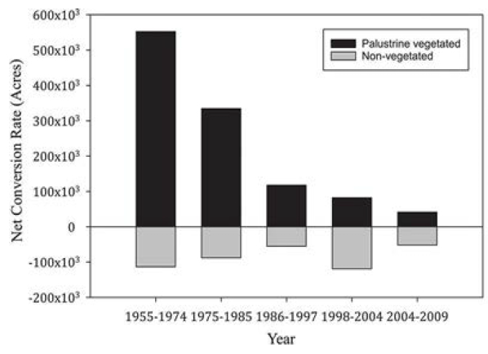

While wetlands have been converted for uses like subdivisions at a steady rate since the 1950s, they were converted, usually drained, for crop fields at a very rapid rate from 1955 to 1974 (Figure 15.1). In that 18-year timespan, there was a net loss of 8.2 million acres of wetlands, an area the size of Maryland. Loss of palustrine wetlands (valuable marshes, swamps, and bogs) was even larger, with most of the additions coming in the form of farm ponds (non-vegetated in Figure 15.1). Fortunately, this rate declined from 458,000 acres per year to 290,000 in the 1975–1985 time frame and then declined further to only 58,000 in 1986–1997, a net gain of 32,000 acres per year in 1998–2004, and a slow loss of 13,800 in 2005–2009, when the last wetland inventory was taken. What policies are responsible for slowing down the wetland drainage train?

The legal definition of wetlands has been one of the most tortuous legal footballs in U.S. natural resources policy. As we know from Chapters 11 on land and 12 on water, most land in the U.S. is owned privately while water is fundamentally public. But where does the land end and the water begin? The answer is usually in a wetland. So who owns the wetlands, private landowners or the public, and who manages them on the public’s behalf? You can imagine that more than a few lawyers and politicians have wrestled with this thorny question! So has the U.S. Supreme Court in a series of cases that have drawn and redrawn the boundary between private land and public wetlands time and time again.

The Clean Water Act of 1972 Section 404 is the primary bone of contention. Through the legal doctrine of navigation servitude, the U.S. Army Corps of Engineers (Corps) has jurisdiction over navigable waters like the Mississippi River that often cross state boundaries. It also, therefore, regulates dredging and filling in these waters. The 1975 case Natural Resources Defense Council v. Callaway established that Clean Water Act Section 404 gives the Corps jurisdiction over “Waters of the United States.” The 1985 case United States v. Riverside Bayview Homes Inc. established that wetlands adjacent to navigable waters are also under Corps jurisdiction. But what about a marsh in a farmer’s field? The 2006 case Rapanos v. United States and other cases established that a “significant hydrologic nexus” to navigable waters must exist for a wetland to come under the Corps’ Section 404 authority. That includes a swamp along the Mississippi but excludes the marsh in that farmer’s field. Each of these court decisions based on a logical test radically alters the map of Waters of the U.S., and therefore of protected wetlands, by tens of millions of acres. In the case of Rapanos, it also leaves so much ambiguity that a map cannot be drawn.

In an attempt to remedy this ambiguity, on October 3, 2022, the U.S. Supreme Court heard the case Sackett v. Environmental Protection Agency. Some time in early 2023 we will all hear what a wetland is, or more precisely, an answer to the critical legal question, where beyond the water’s edge does federal jurisdiction under the Clean Water Act extend? Will Justices Alito, Gorsuch and Thomas identify a rule that greatly limits federal jurisdiction? Will Justices Jackson, Kagan and Sotomayor take EPA’s perspective? Or, more likely, will Justices Barrett, Cavanaugh and Roberts identify a compromise rule that can be applied on the ground so that my friends who do GIS can produce a map of the Waters of the United States?

Conclusion

So you still don’t want to be an environmental policy wonk. I understand. Nevertheless, what I hope you’ve learned from this chapter is that environmental policy is important because it creates a decision environment in which natural resources sustainability is nurtured or discouraged, rewarded or ignored. It is also hotly contested and unabashedly political.

Sustainability is not going to come from Washington or from state capitals but the decisions made there set the landscape in which the bike ride to natural resources sustainability is either a downhill coast or a standing-on-the-pedals, thigh-burning uphill pump. If all environmental policy does is put people on the flat terrain and get out of the way, I’m optimistic that they can pedal to sustainability at a steady clip. Better yet would be a decision-environment in which polluters pay and ecosystem service providers get paid. We’re a long way from that landscape but every progressive change gets more people, ordinary people who don’t compete in the Tour de France, on their bikes riding toward natural resources sustainability.

Further Reading

Farber, D. 2014. Environmental Law in a Nutshell, 9th Ed. St Paul, MN: West Academic Publishing.

Ruhl, J., S. Kraft and C. Lant, 2007. The Law and Policy of Ecosystem Services. Island Press, Covelo, CA.

Media Attributions |

|